Today’s article is by Scott Kubie, CFA, Senior Investment Strategist of Omaha, Nebraska-based Carson Group.

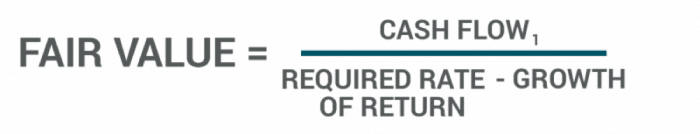

A stock’s long-term value is derived from three factors: growth, cash flow and risk. As the equation below shows, the constant growth model estimates fair value by dividing the cash flow one year from now by the difference between the required rate of return and the constant growth estimate.

Beyond being an elegant way to estimate long-term market value, this equation also offers a guide to how markets can get out of whack.

When investors’ estimates divorce themselves from reality, they overpay for stocks. The last two major market declines came from investors misestimating the growth prospects and cash flow of corporations.

During the dot-com bubble, investors overestimated growth, pushing valuations to extremes. In the financial crisis of 2008, cash flow was overstated, as banks booked profits on loans that wouldn’t be repaid.

Some investors continue to focus on the two most recent large downturns for indications that trouble is on the horizon. But we believe the next trouble spot will more likely come from the third part of the equation: risk. If risk estimates become too low, investors will pay too much and suffer when risk returns to normal levels.

Complacency About Risk

The spoiler is this is already happening. The low-risk expectations suggest investors have become too complacent and are ignoring a number of risks.

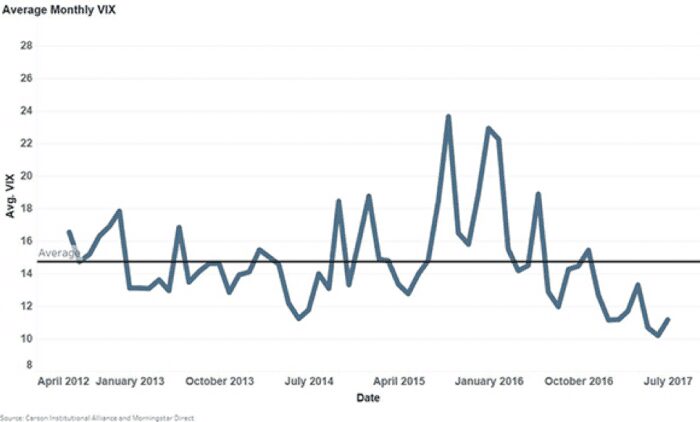

Market risk levels, based on the CBOE’s Volatility Index (VIX), have dropped to historic lows. The market continues to hum along, and the danger is that investors will steadily bid up a suddenly less-volatile stock market.

Of course, the very act of bidding up returns pushes volatility down with a steady flow of new investments, further extending the trend—at least until a shock pushes risk up and causes a large reassessment.

Then, complacent investors can quickly become scared investors, increasing the risk of a sharp market downturn.

How should you, as an investor, respond to a market where a sharp downturn is likely?

- Don’t use up all your risk budget, because risk is higher than you think: Avoid high-yield bonds and other risk-extending asset classes.

- Don’t get out of the market: You never know how long the market can keep plugging along, and there are pockets of value out there.

- Be wary of the winners: The iShares S&P 500 Growth ETF (IVW) has outpaced the iShares MSCI EAFE Value ETF (EFV)by almost 9% per year. That seems unlikely to continue.

- Use short-term, inflation-linked bonds to reduce risk: Correlations are increasing for bonds, and short-term, inflation-linked securities are poised to take advantage of any inflation scares that spook the market. The PIMCO 1-5 Year US TIPS Index ETF (STPZ) protects against inflation while avoiding the heightened risk in U.S. Treasury markets.

- Be ready to commit: Regardless of the ETFs you buy, have a plan for taking advantage of turmoil.

- Most importantly: Remain respectful of risk—especially when others are not.

At the time of writing, the author held no positions in the securities mentioned. For a list of disclosures, please click here.