Blog

Array

(

[showposts] => 5

[post_type] => post

[post_status] => publish

)

WP_Query Object

(

[query] => Array

(

[showposts] => 5

[post_type] => post

[post_status] => publish

)

[query_vars] => Array

(

[showposts] => 5

[post_type] => post

[post_status] => publish

[error] =>

[m] =>

[p] => 0

[post_parent] =>

[subpost] =>

[subpost_id] =>

[attachment] =>

[attachment_id] => 0

[name] =>

[pagename] =>

[page_id] => 0

[second] =>

[minute] =>

[hour] =>

[day] => 0

[monthnum] => 0

[year] => 0

[w] => 0

[category_name] =>

[tag] =>

[cat] =>

[tag_id] =>

[author] =>

[author_name] =>

[feed] =>

[tb] =>

[paged] => 0

[meta_key] =>

[meta_value] =>

[preview] =>

[s] =>

[sentence] =>

[title] =>

[fields] =>

[menu_order] =>

[embed] =>

[category__in] => Array

(

)

[category__not_in] => Array

(

)

[category__and] => Array

(

)

[post__in] => Array

(

)

[post__not_in] => Array

(

)

[post_name__in] => Array

(

)

[tag__in] => Array

(

)

[tag__not_in] => Array

(

)

[tag__and] => Array

(

)

[tag_slug__in] => Array

(

)

[tag_slug__and] => Array

(

)

[post_parent__in] => Array

(

)

[post_parent__not_in] => Array

(

)

[author__in] => Array

(

)

[author__not_in] => Array

(

)

[search_columns] => Array

(

)

[ignore_sticky_posts] =>

[suppress_filters] =>

[cache_results] => 1

[update_post_term_cache] => 1

[update_menu_item_cache] =>

[lazy_load_term_meta] => 1

[update_post_meta_cache] => 1

[posts_per_page] => 5

[nopaging] =>

[comments_per_page] => 50

[no_found_rows] =>

[order] => DESC

)

[tax_query] => WP_Tax_Query Object

(

[queries] => Array

(

)

[relation] => AND

[table_aliases:protected] => Array

(

)

[queried_terms] => Array

(

)

[primary_table] => wp_posts

[primary_id_column] => ID

)

[meta_query] => WP_Meta_Query Object

(

[queries] => Array

(

)

[relation] =>

[meta_table] =>

[meta_id_column] =>

[primary_table] =>

[primary_id_column] =>

[table_aliases:protected] => Array

(

)

[clauses:protected] => Array

(

)

[has_or_relation:protected] =>

)

[date_query] =>

[request] => SELECT SQL_CALC_FOUND_ROWS wp_posts.ID

FROM wp_posts

WHERE 1=1 AND wp_posts.post_type = 'post' AND ((wp_posts.post_status = 'publish'))

ORDER BY wp_posts.post_date DESC

LIMIT 0, 5

[posts] => Array

(

[0] => WP_Post Object

(

[ID] => 17967

[post_author] => 4345

[post_date] => 2023-02-02 09:22:13

[post_date_gmt] => 2023-02-02 15:22:13

[post_content] => By Kevin Oleszewski CFP®, MST, EA, Senior Wealth Planner

Multiple retirement savings vehicles are available but having options can be overwhelming. Each option comes with different rules leading to a variance of outcomes in the short-term and long-term. It’s not that dissimilar to choosing what to eat. There are options which are satisfying in the short-term but may necessitate a more vigorous workout later to compensate. Other menu options might be less satisfying immediately but reduce the need to work out as intensely. Similar to how different foods affect the way the body is fueled, retirement contribution choices affect the fuel for retirement. How you save is just as important as how much you save.

Traditional IRA vs. Roth IRA

One example of two similar, yet very different, retirement saving vehicles are Traditional IRAs and Roth IRAs. Both are Individual Retirement Accounts meaning the account is opened and funded by the worker and are tax-advantaged accounts designed for retirement savings. Certain other types of retirement accounts are sponsored by employers and can be funded with both worker and employer contributions. Traditional and Roth IRAs can be distinguished by their tax treatment. So how do they differ and how does each fuel retirement?

Traditional IRA

The Traditional IRA is what usually comes to mind when hearing about an IRA. Often, it’s called a simple IRA, whereas a Roth IRA goes by its full name or Roth for short. The features commonly associated with an IRA include tax-deductible contributions and tax-deferred growth. Because Traditional IRA contributions are made during income-earning years for a time when earned income ends or is reduced (and tax liabilities are frequently lower), the IRA can be a nice way to reduce the current income tax liability while also targeting retirement saving goals.

Traditional IRAs provide tax benefits at the point of contribution for those within the income limits for qualification of a tax deduction. Whether an employer-sponsored retirement plan is offered affects the income limits for contribution deductibility. In 2023, for example, the Modified Adjusted Gross Income (MAGI) limits are as follows:

| Single / Head of Household | Married Filing Jointly | Married Filing Separately | |

| No Employer Retirement Plan | No Limit | Phase Out $218,000 - $228,000 No Limit if spouse is not covered by a plan | Phase Out $1 - $10,000 No Limit if spouse is not covered by a plan |

| Employer Retirement Plan | Phase Out $73,000 - $83,000 | Phase Out $116,000 - $136,000 | Phase Out $1 - $10,000 |

Roth IRA

Like the Traditional IRA, the Roth IRA (Roth) benefits from tax-deferred growth. Unlike the Traditional IRA, Roth account contributions are not tax-deductible. Roth accounts, however, have two attractive features the IRA does not offer: tax-free distributions and no required minimum distribution necessity. Because minimum distributions are not required, Roth accounts can benefit from tax-deferred growth until the account owner chooses to take a distribution. Roth assets can be used to manage taxable income during retirement by providing a tax-free stream of income and funds not withdrawn before death maintain their tax character for the account beneficiary. Only qualified Roth distributions are tax-free and penalty-free so it’s a good idea to know the requirements for a distribution to be qualified:- Over age 59½ AND at least 5 years has passed since the Roth was first opened and funded

- Death or disability

- Qualified first-time home purchase

- Distributions part of a series of substantially equal payments (greater of 5 years or age 59½)

- Unreimbursed medical expenses exceeding 10% AGI

- Medical insurance premiums after a job loss

- Distributions not more than qualified higher education expenses (self or eligible family)

- Distributions due to an IRS levy

- Qualified reservist distribution

- Qualified disaster recovery assistance distribution

| Single / Head of Household | Married Filing Jointly | Married Filing Separately |

| Phase Out $138,000 - $153,000 | Phase Out $218,000 - $228,000 | Phase Out $1 - $10,000 |

This article is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought.

[post_title] => Should I Open a Traditional or Roth IRA? [post_excerpt] => Multiple retirement savings vehicles are available but having options can be overwhelming. Each option comes with different rules leading to a variance of outcomes in the short-term and long-term. It’s not that dissimilar to choosing what to eat. [post_status] => publish [comment_status] => closed [ping_status] => closed [post_password] => [post_name] => should-you-invest-in-a-roth-or-traditional-ira [to_ping] => [pinged] => [post_modified] => 2023-02-13 08:25:05 [post_modified_gmt] => 2023-02-13 14:25:05 [post_content_filtered] => [post_parent] => 0 [guid] => https://www.carsonwealth.com/?p=17967 [menu_order] => 0 [post_type] => post [post_mime_type] => [comment_count] => 0 [filter] => raw ) [1] => WP_Post Object ( [ID] => 77450 [post_author] => 90034 [post_date] => 2023-01-25 13:02:37 [post_date_gmt] => 2023-01-25 19:02:37 [post_content] => At long last, The Carson Investment Research team is proud to officially release our 2023 Market and Economic Outlook, aptly titled Outlook ’23: The Edge of Normal. You can download the whitepaper here. As you are all painfully aware, 2022 wasn’t pretty for investors – it was the first year to ever see both stocks and bonds down 10% or more. Higher-than-expected inflation was the theme of 2022, surging to the highest level since 1981. Add an aggressive Federal Reserve and an unfortunate war in Ukraine, and the result was a very poor year for investors and growing uncertainty for the U.S. and global economies. A bleak year, no doubt, but where do we go from here? We in the Carson Research team believe there are many potential reasons to be optimistic about the year ahead. For example, Inflation already started to pull back in the second half of 2022, and 2023 may actually be disinflationary, with several factors that drove inflation higher last year reversing this year.

For example, Inflation already started to pull back in the second half of 2022, and 2023 may actually be disinflationary, with several factors that drove inflation higher last year reversing this year.

This could allow the Fed to slow down on the aggressive policy stance, and although it won’t be easy, we think there’s an above-average chance we can avoid a recession in 2023. Much like you don’t drive looking out of the rearview mirror, to look backward to predict what could be next isn’t wise. Housing and manufacturing could be headed to recessions, but the consumer remains the most important and largest part of the economy, and they are still very healthy.

Just because 2022 was a poor year for stocks and bonds doesn’t mean the same will be true for 2023 (past performance isn’t indicative of future results). Stocks and bonds could bounce back nicely, with the potential for stocks to lead the way higher and for bonds to begin meaningfully contributing to investors’ portfolios again.

This could allow the Fed to slow down on the aggressive policy stance, and although it won’t be easy, we think there’s an above-average chance we can avoid a recession in 2023. Much like you don’t drive looking out of the rearview mirror, to look backward to predict what could be next isn’t wise. Housing and manufacturing could be headed to recessions, but the consumer remains the most important and largest part of the economy, and they are still very healthy.

Just because 2022 was a poor year for stocks and bonds doesn’t mean the same will be true for 2023 (past performance isn’t indicative of future results). Stocks and bonds could bounce back nicely, with the potential for stocks to lead the way higher and for bonds to begin meaningfully contributing to investors’ portfolios again.

We expect stocks to produce a total return of between 12% to 15% in 2023. We also expect a more normal year for bonds, with most of the return coming from yield. Our expectation is that the Bloomberg US Aggregate Bond Index may produce a total return between 4% to 5% in 2023.

You can read the full Outlook ’23: The Edge of Normal here. We hope you find it useful! If you’d like to discuss the report further, or talk about what 2023 might mean for your finances, please reach out.

Schedule a conversation.

We expect stocks to produce a total return of between 12% to 15% in 2023. We also expect a more normal year for bonds, with most of the return coming from yield. Our expectation is that the Bloomberg US Aggregate Bond Index may produce a total return between 4% to 5% in 2023.

You can read the full Outlook ’23: The Edge of Normal here. We hope you find it useful! If you’d like to discuss the report further, or talk about what 2023 might mean for your finances, please reach out.

Schedule a conversation.

Communication Is Key

Your preparer should tell you when to expect the engagement letters, organizers, etc., and when they need all the information by to finalize or extend the return before the deadline. Adhering to their timeline and providing documents in the instructed manner (such as through a client portal or a secure drop box) will reduce any back and forth and minimize the chance that your preparer misses something you already provided. If you’re asked to complete a questionnaire or organizer, there’s a reason why. Those two documents cover most, if not all, of what you will need to provide for your return to be complete and accurate. Most of life’s major events have a tax impact, so it’s important to keep your preparer apprised. Marriage, divorce, births/adoptions, deaths, home purchases and sales, new business ventures and side hustles, and inheritances are a few examples of events that have tax consequences.Documentation Needed for Your Tax Return

Any government-issued forms, such as W-2s, 1099s, 1098s, and K-1s, you receive are all reported to the IRS. If your return is missing information reported on one of these forms, the IRS and state taxing authorities will reconcile your return and issue notice adjusting the return to match what was reported. This can result in additional tax owed, plus penalties and interest. Other information, such as business income and expenses, medical expenses, charitable contributions, and some tax strategies, is not reported to the IRS and sufficient records must be maintained. Examples of income reported to the IRS:- Form W-2

- Form 1099s from all sources, including:

- • Bank interest

- • Brokerage accounts

- • Stock dividends

- • Stock sales

- • Sale of real estate

- • Nonemployee business income/payments on the 1099-NEC

- • Social Security

- • Retirement account distributions and other retirement income

- • Cancellation of debt

- • Unemployment, state tax refunds, and other government payments

- • 529 distributions

- • Rents and royalties

- • Miscellaneous income

- Form K-1s from all sources, including:

- • Trusts

- • Partnerships

- • S Corporations

- Form 1098s from all sources, including:

- • Mortgage interest

- • Tuition

- • Student loan interest

- Form 5498s with retirement account information

- Business income and expenses

- Medical expenses

- Charitable contributions, including Donor Advised Funds and Qualified Charitable Distributions

- State and local tax payments, including real estate, personal property, and sales taxes

- Contributions to tax-advantaged accounts, including IRAs, 529s, and HSAs

- Tax basis for equity compensation transactions

What If I Need to File an Extension?

For many taxpayers, not all the information is available to file a return by the April 15 deadline (March 15 for corporate and partnership filers). K-1s are a common reason for extending, as returns for entities issuing K-1s generally require additional time given the complexity of the return. Sometimes life events make it impractical or too stressful to collect all the documents on time. It’s okay to extend if you need to do so. There is no penalty or downside to filing an extension. Once extended, the filing deadline for individual returns is October 15 (September 15 for corporate and partnership filers, September 30 for trusts and estates). Please note that an extension is an extension of time to file the return, not to pay the tax due. The IRS still requires 100% of the total tax liability be paid or withheld by the April 15 deadline. This is an important distinction. Your preparer should be able to assist you in filing an extension and making the requisite payments. Many preparers have a due date (usually mid-March) for you to provide documents in order to file the return before the April 15 deadline. If you think you may be unable to provide all your information by that date, talk to your preparer to determine whether an extension is appropriate.Provide All the Documentation as Early as Possible

Most tax documents are issued in January. Brokerage account 1099s are typically available by mid-February. The quicker you can provide all the documents to your preparer, the earlier your return can be prepared. Avoid sending documents one-by-one – sending all the documents at once to your preparer will allow them to start working on the return sooner. If you have all but one or two documents, ask your preparer for their preference as to when you should send in your tax documents. Tax season is rarely fun, but a great working relationship with your tax preparer can reduce the stress caused by April 15. For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera Advisor Networks LLC nor any of its representatives may give legal or tax advice. [post_title] => What Documents You Should Provide to Your Tax Preparer [post_excerpt] => [post_status] => publish [comment_status] => closed [ping_status] => closed [post_password] => [post_name] => what-documents-you-should-provide-to-your-tax-preparer [to_ping] => [pinged] => [post_modified] => 2023-02-07 08:15:52 [post_modified_gmt] => 2023-02-07 14:15:52 [post_content_filtered] => [post_parent] => 0 [guid] => https://carsonhub.wpengine.com/?p=65628 [menu_order] => 0 [post_type] => post [post_mime_type] => [comment_count] => 0 [filter] => raw ) [3] => WP_Post Object ( [ID] => 52562 [post_author] => 99865 [post_date] => 2023-01-05 17:05:19 [post_date_gmt] => 2023-01-05 23:05:19 [post_content] => There’s more to tax planning than you think. Do you understand how each of your accounts are taxed? How did you set up your retirement plan? Have you considered an HSA? Take control of your taxes and how they fit into the big picture. Check out these income tax planning tips. Click here to open fullscreen [post_title] => 10 Tax Planning Tips That Could Reduce Your Taxes [post_excerpt] => [post_status] => publish [comment_status] => closed [ping_status] => closed [post_password] => [post_name] => 10-tax-planning-tips-your-cpa-might-have-missed-2 [to_ping] => [pinged] => [post_modified] => 2023-02-02 11:06:51 [post_modified_gmt] => 2023-02-02 17:06:51 [post_content_filtered] => [post_parent] => 0 [guid] => https://www.carsonwealth.com/?post_type=infographics&p=52562 [menu_order] => 0 [post_type] => post [post_mime_type] => [comment_count] => 0 [filter] => raw ) [4] => WP_Post Object ( [ID] => 77408 [post_author] => 182385 [post_date] => 2023-01-05 13:15:41 [post_date_gmt] => 2023-01-05 19:15:41 [post_content] => Mike Valenti, CPA, CFP®, Director of Tax Planning Qualified retirement plans – such as 401(k)s, 403(b)s and IRAs – offer clear tax advantages. Traditional 401(k)s, 403(b)s, and IRAs offer a tax deferral on contributions and growth until distribution. Their Roth counterparts can provide an inverse benefit: Contributions are taxed up front, but growth and qualified distributions are tax-free. To prevent individuals from taking advantage of the tax-deferred growth in perpetuity, there are certain rules in place. One of those is the Required Minimum Distribution (RMD) rule. Taxpayers with qualified retirement accounts are required to start taking distributions from the accounts once a certain age is reached. That age was 70½ prior to 2020, 72 from 2020 to 2022, and will be 73 starting in 2023 with the passage of the SECURE 2.0 Act. The bill also includes a provision to increase the RMD age in ten years to 75. Note: those who are beneficiaries of inherited retirement accounts may also be subject to RMDs, but that topic is not covered here.RMD Basics

The RMD rules apply to all employer-sponsored qualified retirement accounts (401(k)s, 403(b)s, etc.) and IRAs, with exception of Roth IRAs – and beginning in 2024, due to the SECURE 2.0 Act provisions, Roth 401(k)s. If someone is still working at or beyond the RMD age and their company offers a qualified retirement plan such as a 401(k), the distribution requirement for that plan specifically is deferred until the person retires or otherwise stops working for that company. If you own more than 5% of the company when you hit your required beginning age you would still need to take RMDs from that company plan. Due to the mechanics of the RMD age increase from 72 to 73 in 2023, a smaller subset of people will be required to take their first distribution in 2023. If you turned 72 in 2022, your first RMD would need to come out by April 1, 2023 and a second RMD, for 2023, would need to be distributed by December 31, 2023. Thus, the only people required to take their first RMD in 2023 will be those who continued to work past the RMD age and are retiring in 2023. The RMD amount – the minimum amount that must be withdrawn and subject to tax – is calculated using life-expectancy tables provided by the IRS. The intent is to draw down tax-advantaged retirement accounts over the life of the taxpayer. As a result, the minimum distribution amount will change every year depending on the current age factor and the prior year’s distributions and market performance. The minimum distribution is required to be taken by year-end, with one exception. In the first year an RMD is required to be taken, there is a three-month grace period and the distribution needs to be taken by April 1st of the following year to avoid penalty. The second year’s RMD is still required to be taken that year, so this does result in two distributions the second year. The RMD age should not be confused with the age 59½ threshold, which is when an individual can start taking distributions without penalty.How to Calculate Your RMD Amount

As noted above, the minimum distribution is calculated by using a formula based on a life expectancy factor provided by the IRS, which can be referenced in IRS Publication 590-B. The factor is primarily based on age, but also the spouse’s age, if applicable. Most people will use the Uniform Life Expectancy Table, but those with spouses 10+ years younger who are the sole beneficiaries of the account are subject to the Joint Life and Last Survivor Expectancy Table, which takes into account that the younger spouse may live significantly longer and may rely on the inherited assets well past the death of the first spouse. To calculate the RMD, the balance of the applicable accounts on the last day of the prior tax year (December 31, 2022 for 2023 distributions) is divided by the life expectancy factor. While there is not a requirement to take distributions from every single account, i.e., a distribution from one IRA can suffice for all IRAs, there is a distinction between IRAs and employer-sponsored accounts. If you have IRAs and a 401(k), two pro rata distributions must be taken: one from an IRA to meet the RMD for the collective IRAs and one from the 401(k) to cover for the employer-sponsored plan(s). For a simple example, assume you are 73, single or have a spouse the same age and have $50,000 in a 401(k) and $50,000 in an IRA for a total of $100,000. Your life expectancy factor is 26.5. Divide $100,000 by 26.5 and your total RMD for the year is $3,774, and furthermore, at least $1,887 is required to be withdrawn from each account.How to Take the RMD

To take the distribution, you must direct the account custodian to make the distribution. There will be a form to fill out, which includes how much to withdraw, when to withdraw, how and where the distribution will be paid, and how much in taxes to withhold. The default federal tax withholding is 10%, but you can request specific amounts or percentages to be withheld for federal and state taxes. Some custodians will allow you to set up automatic distributions, which can be helpful if you have multiple and/or smaller accounts to ensure the RMD is not missed. For tax reporting purposes, you will get a 1099R that lists the distributions and taxes withheld. You should always provide this form to your tax preparer. Prior to 2023, failing to take the RMD could result in a costly 50% penalty on the minimum distribution not taken. Due the SECURE 2.0 Act, the amount not withdrawn is now penalized at 25%, with a reduction to 10% if corrected in a timely manner.Choosing an RMD Strategy for You

In the first year, although you have grace period, it generally makes sense to take the first RMD to reduce the overall tax liability. However, in certain circumstances, it could be worth considering a delay until the following year. As examples, if you are retiring this year with a sizeable severance package or you expect to have significant gains (perhaps from the sale of property), it could make sense to defer the income to the following year. You will double up on your RMDs in 2024, but you'll be paying less in taxes overall if properly planned. A very common planning strategy involving RMDs is to use them as a vehicle to withhold taxes. Once you have a good idea of what your net tax liability will be for the year – typically in November or December – you can take your distribution and withhold the necessary taxes needed for the year. The custodian will then pay federal and state tax authorities and remit the balance to you. This is generally more attractive than making estimated tax payments during the year because the tax withheld from your RMD is considered ratably paid throughout the year and can reduce the chance of an underpayment penalty due to a timing mismatch between income and estimated payments. There is no limit on the number of distributions you can pull throughout the year, other than what your custodian may impose. You can take them yearly, monthly, or even bi-weekly if you wish, to cover living expenses. Additionally, there is no maximum distribution other than the account’s balance. If, for example, your RMD is $100,000, but you need $120,000 for living expenses, you can withdraw $120,000 or more to meet your needs. Perhaps a monthly distribution of $10,000 is more attractive. On top of those distributions, you could take a year-end distribution to cover the expected tax liability.Consult with Your Advisors

Given the complexity of the RMD calculation and process, you should always consult with your financial planner and/or tax advisor to discuss how much to withdraw, how much to withhold, and when to take to the distributions as you near age 73. Jamie is not registered with CWM, LLC as an investment advisor representative and does not provide product recommendations or investment advice. Distributions from traditional IRA’s and employer sponsored retirement plans are taxed as ordinary income and, if taken prior to reaching age 59 ½, may be subject to an additional 10% IRS tax penalty. For a comprehensive review of your personal situation, always consult with a tax or legal advisor. CWM, LLC, any other named entity or any of their representatives may not give legal or tax advice. [post_title] => Planning for Your First Required Minimum Distribution in Retirement [post_excerpt] => [post_status] => publish [comment_status] => closed [ping_status] => closed [post_password] => [post_name] => planning-for-your-first-required-minimum-distribution-in-retirement [to_ping] => [pinged] => [post_modified] => 2023-01-17 09:50:49 [post_modified_gmt] => 2023-01-17 15:50:49 [post_content_filtered] => [post_parent] => 0 [guid] => https://carsonhub.wpengine.com/?p=65589 [menu_order] => 0 [post_type] => post [post_mime_type] => [comment_count] => 0 [filter] => raw ) ) [post_count] => 5 [current_post] => -1 [before_loop] => 1 [in_the_loop] => [post] => WP_Post Object ( [ID] => 17967 [post_author] => 4345 [post_date] => 2023-02-02 09:22:13 [post_date_gmt] => 2023-02-02 15:22:13 [post_content] => By Kevin Oleszewski CFP®, MST, EA, Senior Wealth Planner Multiple retirement savings vehicles are available but having options can be overwhelming. Each option comes with different rules leading to a variance of outcomes in the short-term and long-term. It’s not that dissimilar to choosing what to eat. There are options which are satisfying in the short-term but may necessitate a more vigorous workout later to compensate. Other menu options might be less satisfying immediately but reduce the need to work out as intensely. Similar to how different foods affect the way the body is fueled, retirement contribution choices affect the fuel for retirement. How you save is just as important as how much you save.Traditional IRA vs. Roth IRA

One example of two similar, yet very different, retirement saving vehicles are Traditional IRAs and Roth IRAs. Both are Individual Retirement Accounts meaning the account is opened and funded by the worker and are tax-advantaged accounts designed for retirement savings. Certain other types of retirement accounts are sponsored by employers and can be funded with both worker and employer contributions. Traditional and Roth IRAs can be distinguished by their tax treatment. So how do they differ and how does each fuel retirement?Traditional IRA

The Traditional IRA is what usually comes to mind when hearing about an IRA. Often, it’s called a simple IRA, whereas a Roth IRA goes by its full name or Roth for short. The features commonly associated with an IRA include tax-deductible contributions and tax-deferred growth. Because Traditional IRA contributions are made during income-earning years for a time when earned income ends or is reduced (and tax liabilities are frequently lower), the IRA can be a nice way to reduce the current income tax liability while also targeting retirement saving goals. Traditional IRAs provide tax benefits at the point of contribution for those within the income limits for qualification of a tax deduction. Whether an employer-sponsored retirement plan is offered affects the income limits for contribution deductibility. In 2023, for example, the Modified Adjusted Gross Income (MAGI) limits are as follows:| Single / Head of Household | Married Filing Jointly | Married Filing Separately | |

| No Employer Retirement Plan | No Limit | Phase Out $218,000 - $228,000 No Limit if spouse is not covered by a plan | Phase Out $1 - $10,000 No Limit if spouse is not covered by a plan |

| Employer Retirement Plan | Phase Out $73,000 - $83,000 | Phase Out $116,000 - $136,000 | Phase Out $1 - $10,000 |

Roth IRA

Like the Traditional IRA, the Roth IRA (Roth) benefits from tax-deferred growth. Unlike the Traditional IRA, Roth account contributions are not tax-deductible. Roth accounts, however, have two attractive features the IRA does not offer: tax-free distributions and no required minimum distribution necessity. Because minimum distributions are not required, Roth accounts can benefit from tax-deferred growth until the account owner chooses to take a distribution. Roth assets can be used to manage taxable income during retirement by providing a tax-free stream of income and funds not withdrawn before death maintain their tax character for the account beneficiary. Only qualified Roth distributions are tax-free and penalty-free so it’s a good idea to know the requirements for a distribution to be qualified:- Over age 59½ AND at least 5 years has passed since the Roth was first opened and funded

- Death or disability

- Qualified first-time home purchase

- Distributions part of a series of substantially equal payments (greater of 5 years or age 59½)

- Unreimbursed medical expenses exceeding 10% AGI

- Medical insurance premiums after a job loss

- Distributions not more than qualified higher education expenses (self or eligible family)

- Distributions due to an IRS levy

- Qualified reservist distribution

- Qualified disaster recovery assistance distribution

| Single / Head of Household | Married Filing Jointly | Married Filing Separately |

| Phase Out $138,000 - $153,000 | Phase Out $218,000 - $228,000 | Phase Out $1 - $10,000 |

This article is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought.

[post_title] => Should I Open a Traditional or Roth IRA? [post_excerpt] => Multiple retirement savings vehicles are available but having options can be overwhelming. Each option comes with different rules leading to a variance of outcomes in the short-term and long-term. It’s not that dissimilar to choosing what to eat. [post_status] => publish [comment_status] => closed [ping_status] => closed [post_password] => [post_name] => should-you-invest-in-a-roth-or-traditional-ira [to_ping] => [pinged] => [post_modified] => 2023-02-13 08:25:05 [post_modified_gmt] => 2023-02-13 14:25:05 [post_content_filtered] => [post_parent] => 0 [guid] => https://www.carsonwealth.com/?p=17967 [menu_order] => 0 [post_type] => post [post_mime_type] => [comment_count] => 0 [filter] => raw ) [comment_count] => 0 [current_comment] => -1 [found_posts] => 431 [max_num_pages] => 87 [max_num_comment_pages] => 0 [is_single] => [is_preview] => [is_page] => [is_archive] => [is_date] => [is_year] => [is_month] => [is_day] => [is_time] => [is_author] => [is_category] => [is_tag] => [is_tax] => [is_search] => [is_feed] => [is_comment_feed] => [is_trackback] => [is_home] => 1 [is_privacy_policy] => [is_404] => [is_embed] => [is_paged] => [is_admin] => [is_attachment] => [is_singular] => [is_robots] => [is_favicon] => [is_posts_page] => [is_post_type_archive] => [query_vars_hash:WP_Query:private] => 16a8d0bb21ecb40704840455d35ff6b9 [query_vars_changed:WP_Query:private] => [thumbnails_cached] => [allow_query_attachment_by_filename:protected] => [stopwords:WP_Query:private] => [compat_fields:WP_Query:private] => Array ( [0] => query_vars_hash [1] => query_vars_changed ) [compat_methods:WP_Query:private] => Array ( [0] => init_query_flags [1] => parse_tax_query ) [tribe_is_event] => [tribe_is_multi_posttype] => [tribe_is_event_category] => [tribe_is_event_venue] => [tribe_is_event_organizer] => [tribe_is_event_query] => [tribe_is_past] => )Carson Investment Research’s Outlook ’23: The Edge of Normal

What Documents You Should Provide to Your Tax Preparer

10 Tax Planning Tips That Could Reduce Your Taxes

Planning for Your First Required Minimum Distribution in Retirement

Array

(

[showposts] => 5

[post_type] => free-guides

[post_status] => publish

)

WP_Query Object

(

[query] => Array

(

[showposts] => 5

[post_type] => free-guides

[post_status] => publish

)

[query_vars] => Array

(

[showposts] => 5

[post_type] => free-guides

[post_status] => publish

[error] =>

[m] =>

[p] => 0

[post_parent] =>

[subpost] =>

[subpost_id] =>

[attachment] =>

[attachment_id] => 0

[name] =>

[pagename] =>

[page_id] => 0

[second] =>

[minute] =>

[hour] =>

[day] => 0

[monthnum] => 0

[year] => 0

[w] => 0

[category_name] =>

[tag] =>

[cat] =>

[tag_id] =>

[author] =>

[author_name] =>

[feed] =>

[tb] =>

[paged] => 0

[meta_key] =>

[meta_value] =>

[preview] =>

[s] =>

[sentence] =>

[title] =>

[fields] =>

[menu_order] =>

[embed] =>

[category__in] => Array

(

)

[category__not_in] => Array

(

)

[category__and] => Array

(

)

[post__in] => Array

(

)

[post__not_in] => Array

(

)

[post_name__in] => Array

(

)

[tag__in] => Array

(

)

[tag__not_in] => Array

(

)

[tag__and] => Array

(

)

[tag_slug__in] => Array

(

)

[tag_slug__and] => Array

(

)

[post_parent__in] => Array

(

)

[post_parent__not_in] => Array

(

)

[author__in] => Array

(

)

[author__not_in] => Array

(

)

[search_columns] => Array

(

)

[ignore_sticky_posts] =>

[suppress_filters] =>

[cache_results] => 1

[update_post_term_cache] => 1

[update_menu_item_cache] =>

[lazy_load_term_meta] => 1

[update_post_meta_cache] => 1

[posts_per_page] => 5

[nopaging] =>

[comments_per_page] => 50

[no_found_rows] =>

[order] => DESC

)

[tax_query] => WP_Tax_Query Object

(

[queries] => Array

(

)

[relation] => AND

[table_aliases:protected] => Array

(

)

[queried_terms] => Array

(

)

[primary_table] => wp_posts

[primary_id_column] => ID

)

[meta_query] => WP_Meta_Query Object

(

[queries] => Array

(

)

[relation] =>

[meta_table] =>

[meta_id_column] =>

[primary_table] =>

[primary_id_column] =>

[table_aliases:protected] => Array

(

)

[clauses:protected] => Array

(

)

[has_or_relation:protected] =>

)

[date_query] =>

[request] => SELECT SQL_CALC_FOUND_ROWS wp_posts.ID

FROM wp_posts

WHERE 1=1 AND wp_posts.post_type = 'free-guides' AND ((wp_posts.post_status = 'publish'))

ORDER BY wp_posts.post_date DESC

LIMIT 0, 5

[posts] => Array

(

[0] => WP_Post Object

(

[ID] => 77523

[post_author] => 90034

[post_date] => 2023-02-02 13:10:52

[post_date_gmt] => 2023-02-02 19:10:52

[post_content] => The following topics are important to keep in mind as you navigate the various individual and employer-sponsored plans that may be available to you.

Download the checklist today to get started.

[post_title] => 7 Important Retirement Savings Topics for 2023

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => 7-important-retirement-savings-topics-for-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2023-02-10 12:12:56

[post_modified_gmt] => 2023-02-10 18:12:56

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://pages.carsonhub.wpengine.com/_resource?guidekey=the-complete-guide-to-the-SECURE-2-0-Act

[menu_order] => 0

[post_type] => free-guides

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[1] => WP_Post Object

(

[ID] => 52484

[post_author] => 181142

[post_date] => 2023-01-05 09:52:37

[post_date_gmt] => 2023-01-05 15:52:37

[post_content] => Tax planning takes into account the larger picture of your investments, assets, estate strategy and other parts of life to protect your finances over decades – not just hope to do better than last year’s income tax return.

From your personal healthcare and retirement plans to working within changes to the tax code, you'll find tax planning opportunities that are easy to miss, but could save you thousands.

Download Guide

[post_title] => 10 Tax Planning Tips That Could Reduce Your Taxes

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => ten-tax-tips

[to_ping] =>

[pinged] =>

[post_modified] => 2023-02-04 02:45:56

[post_modified_gmt] => 2023-02-04 08:45:56

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://www.carsonwealth.com/?post_type=free-guides&p=52484

[menu_order] => 0

[post_type] => free-guides

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[2] => WP_Post Object

(

[ID] => 77399

[post_author] => 90034

[post_date] => 2022-12-28 10:38:11

[post_date_gmt] => 2022-12-28 16:38:11

[post_content] => After multiple attempts at retirement legislation in 2022, the SECURE 2.0 Act has passed, with arguably more impactful reform than its predecessor, the SECURE Act of 2019.

Download the checklist today to get started.

[post_title] => The Complete Guide to the SECURE 2.0 Act

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => the-complete-guide-to-the-secure-2-0-act

[to_ping] =>

[pinged] =>

[post_modified] => 2022-12-28 11:18:24

[post_modified_gmt] => 2022-12-28 17:18:24

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://pages.carsonhub.wpengine.com/_resource?guidekey=2023-calendar

[menu_order] => 0

[post_type] => free-guides

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[3] => WP_Post Object

(

[ID] => 77345

[post_author] => 90034

[post_date] => 2022-12-09 08:59:28

[post_date_gmt] => 2022-12-09 14:59:28

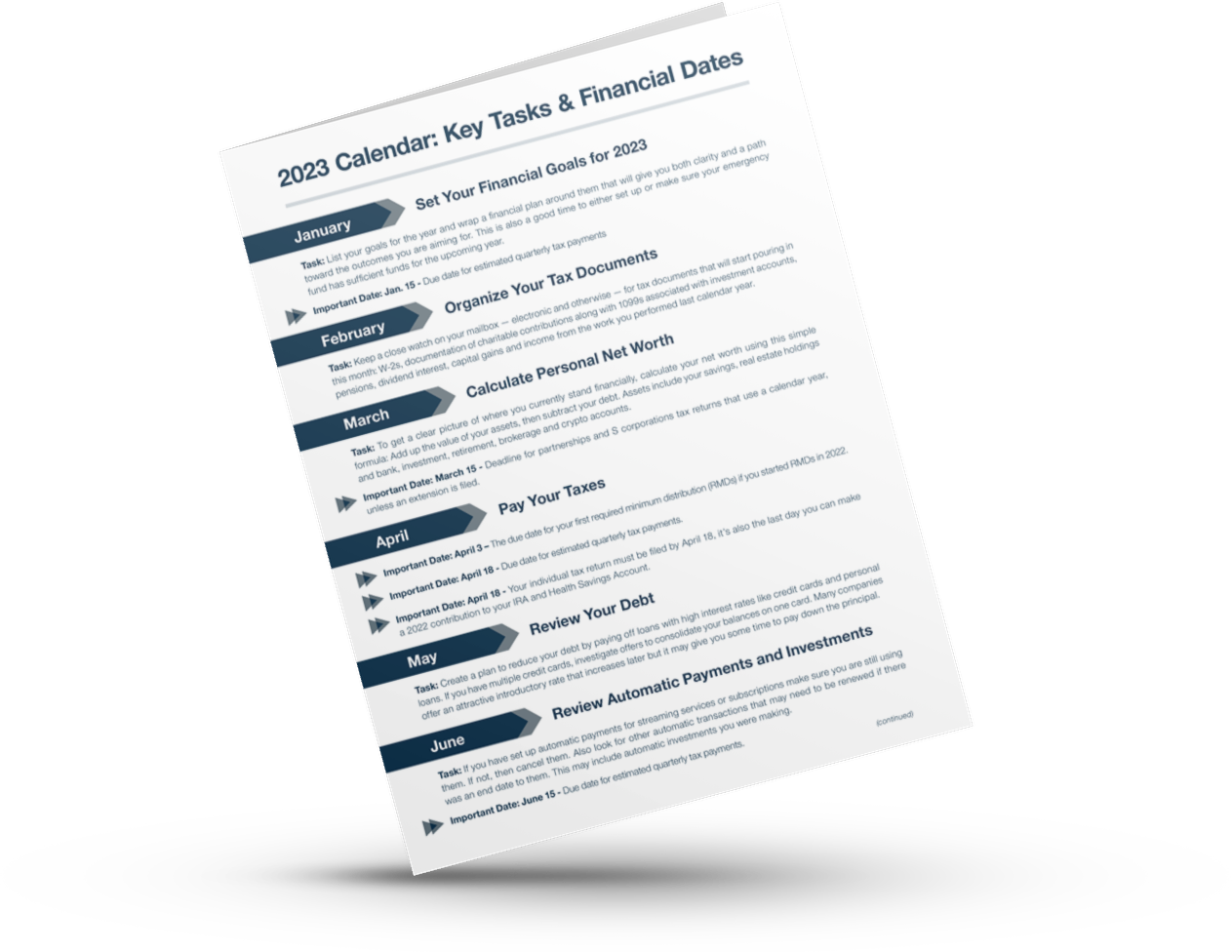

[post_content] => Get ready to tackle 2023 with this month-by-month financial task list. We've also included important dates so you won't miss key deadlines.

Download the checklist today to get started.

[post_title] => 2023 Calendar: Key Tasks & Financial Dates

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => 2023-calendar-key-tasks-financial-dates

[to_ping] =>

[pinged] =>

[post_modified] => 2022-12-09 09:05:21

[post_modified_gmt] => 2022-12-09 15:05:21

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://pages.carsonhub.wpengine.com/_resource?guidekey=investing-for-women

[menu_order] => 0

[post_type] => free-guides

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[4] => WP_Post Object

(

[ID] => 77275

[post_author] => 90034

[post_date] => 2022-11-18 08:49:35

[post_date_gmt] => 2022-11-18 14:49:35

[post_content] => Change happens. And whether we carefully plan for these changes, or we are taken by surprise by change, it's how we react to those changes that help dictate if they will ultimately be to our advantage. Whether it's a sudden inheritance, or a divorce settlement that is higher than anticipated, deciding what to do with an unexpected sum of money should happen after emotions have been processed.

Download the checklist today to get started.

[post_title] => Investing for Women

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => investing-for-women

[to_ping] =>

[pinged] =>

[post_modified] => 2022-11-18 09:05:20

[post_modified_gmt] => 2022-11-18 15:05:20

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://pages.carsonhub.wpengine.com/_resource?guidekey=easy-steps-for-beginning-women-investors

[menu_order] => 0

[post_type] => free-guides

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

)

[post_count] => 5

[current_post] => -1

[before_loop] => 1

[in_the_loop] =>

[post] => WP_Post Object

(

[ID] => 77523

[post_author] => 90034

[post_date] => 2023-02-02 13:10:52

[post_date_gmt] => 2023-02-02 19:10:52

[post_content] => The following topics are important to keep in mind as you navigate the various individual and employer-sponsored plans that may be available to you.

Download the checklist today to get started.

[post_title] => 7 Important Retirement Savings Topics for 2023

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => 7-important-retirement-savings-topics-for-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2023-02-10 12:12:56

[post_modified_gmt] => 2023-02-10 18:12:56

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://pages.carsonhub.wpengine.com/_resource?guidekey=the-complete-guide-to-the-SECURE-2-0-Act

[menu_order] => 0

[post_type] => free-guides

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[comment_count] => 0

[current_comment] => -1

[found_posts] => 50

[max_num_pages] => 10

[max_num_comment_pages] => 0

[is_single] =>

[is_preview] =>

[is_page] =>

[is_archive] =>

[is_date] =>

[is_year] =>

[is_month] =>

[is_day] =>

[is_time] =>

[is_author] =>

[is_category] =>

[is_tag] =>

[is_tax] =>

[is_search] =>

[is_feed] =>

[is_comment_feed] =>

[is_trackback] =>

[is_home] => 1

[is_privacy_policy] =>

[is_404] =>

[is_embed] =>

[is_paged] =>

[is_admin] =>

[is_attachment] =>

[is_singular] =>

[is_robots] =>

[is_favicon] =>

[is_posts_page] =>

[is_post_type_archive] =>

[query_vars_hash:WP_Query:private] => 1bf36ad276d4c58b8aee9c2c55478c12

[query_vars_changed:WP_Query:private] =>

[thumbnails_cached] =>

[allow_query_attachment_by_filename:protected] =>

[stopwords:WP_Query:private] =>

[compat_fields:WP_Query:private] => Array

(

[0] => query_vars_hash

[1] => query_vars_changed

)

[compat_methods:WP_Query:private] => Array

(

[0] => init_query_flags

[1] => parse_tax_query

)

[tribe_is_event] =>

[tribe_is_multi_posttype] =>

[tribe_is_event_category] =>

[tribe_is_event_venue] =>

[tribe_is_event_organizer] =>

[tribe_is_event_query] =>

[tribe_is_past] =>

)

Resources

Resources

7 Important Retirement Savings Topics for 2023

Array

(

[showposts] => 5

[post_type] => market-commentary

[post_status] => publish

)

WP_Query Object

(

[query] => Array

(

[showposts] => 5

[post_type] => market-commentary

[post_status] => publish

)

[query_vars] => Array

(

[showposts] => 5

[post_type] => market-commentary

[post_status] => publish

[error] =>

[m] =>

[p] => 0

[post_parent] =>

[subpost] =>

[subpost_id] =>

[attachment] =>

[attachment_id] => 0

[name] =>

[pagename] =>

[page_id] => 0

[second] =>

[minute] =>

[hour] =>

[day] => 0

[monthnum] => 0

[year] => 0

[w] => 0

[category_name] =>

[tag] =>

[cat] =>

[tag_id] =>

[author] =>

[author_name] =>

[feed] =>

[tb] =>

[paged] => 0

[meta_key] =>

[meta_value] =>

[preview] =>

[s] =>

[sentence] =>

[title] =>

[fields] =>

[menu_order] =>

[embed] =>

[category__in] => Array

(

)

[category__not_in] => Array

(

)

[category__and] => Array

(

)

[post__in] => Array

(

)

[post__not_in] => Array

(

)

[post_name__in] => Array

(

)

[tag__in] => Array

(

)

[tag__not_in] => Array

(

)

[tag__and] => Array

(

)

[tag_slug__in] => Array

(

)

[tag_slug__and] => Array

(

)

[post_parent__in] => Array

(

)

[post_parent__not_in] => Array

(

)

[author__in] => Array

(

)

[author__not_in] => Array

(

)

[search_columns] => Array

(

)

[ignore_sticky_posts] =>

[suppress_filters] =>

[cache_results] => 1

[update_post_term_cache] => 1

[update_menu_item_cache] =>

[lazy_load_term_meta] => 1

[update_post_meta_cache] => 1

[posts_per_page] => 5

[nopaging] =>

[comments_per_page] => 50

[no_found_rows] =>

[order] => DESC

)

[tax_query] => WP_Tax_Query Object

(

[queries] => Array

(

)

[relation] => AND

[table_aliases:protected] => Array

(

)

[queried_terms] => Array

(

)

[primary_table] => wp_posts

[primary_id_column] => ID

)

[meta_query] => WP_Meta_Query Object

(

[queries] => Array

(

)

[relation] =>

[meta_table] =>

[meta_id_column] =>

[primary_table] =>

[primary_id_column] =>

[table_aliases:protected] => Array

(

)

[clauses:protected] => Array

(

)

[has_or_relation:protected] =>

)

[date_query] =>

[request] => SELECT SQL_CALC_FOUND_ROWS wp_posts.ID

FROM wp_posts

WHERE 1=1 AND wp_posts.post_type = 'market-commentary' AND ((wp_posts.post_status = 'publish'))

ORDER BY wp_posts.post_date DESC

LIMIT 0, 5

[posts] => Array

(

[0] => WP_Post Object

(

[ID] => 77555

[post_author] => 90034

[post_date] => 2023-02-13 09:19:44

[post_date_gmt] => 2023-02-13 15:19:44

[post_content] => It has been a great start to 2023 for stocks. We continue to expect higher prices this year, but we don’t anticipate they’ll happen in a straight line. February is sometimes known as a hangover month, and we wouldn’t be too surprised if stocks had a small break during this historically troublesome period.

- Stocks still look very strong, but February can be a tricky month.

- Technology company layoffs have dominated headlines, prompting renewed recession fears.

- Tech firms may simply be retrenching after a torrid pace of hiring over the past decade.

- The good news is the rest of the economy may be picking up the slack.

Putting the Tech Layoffs in Perspective

It’s hard to get away from all the headlines about layoffs in the technology sector. Most recently, Yahoo announced it was laying off 20% of its workforce, about 1,600 people.

The firm Challenger, Gray & Christmas, Inc. tracks layoff announcements, and its most recent report was titled “Jan ’23 Recession or Correction?”. The firm reported that the tech sector announced cuts of 41,829 in January, which amounted to 41% of all announced layoffs. That was the second highest for the sector on record and represented a massive 158% increase over the 16,193 announced in December. Contrast that to January 2022, when there were just 72 announced layoffs in the sector.

Between November 2021 and January 2022, tech sector layoff announcements have totaled 110,793.

Putting the Tech Layoffs in Perspective

It’s hard to get away from all the headlines about layoffs in the technology sector. Most recently, Yahoo announced it was laying off 20% of its workforce, about 1,600 people.

The firm Challenger, Gray & Christmas, Inc. tracks layoff announcements, and its most recent report was titled “Jan ’23 Recession or Correction?”. The firm reported that the tech sector announced cuts of 41,829 in January, which amounted to 41% of all announced layoffs. That was the second highest for the sector on record and represented a massive 158% increase over the 16,193 announced in December. Contrast that to January 2022, when there were just 72 announced layoffs in the sector.

Between November 2021 and January 2022, tech sector layoff announcements have totaled 110,793.

- Stocks have had a huge start to 2023, but a better economy could open the door to continued gains.

- The January employment data show no sign of slowdown.

- The economy does not appear close to a recession.

- Wage growth is trending lower, which should be good news for the Fed as it downshifts the pace of rate hikes and closes in on a peak rate.

- A relatively stronger than expected economy means the Fed is likely to keep rates higher for longer.

- The stock market’s great start to the year continued last week, which could be a good sign as strong starts can open the door to more gains.

- Better overall economic data last week continued to increase the chances of avoiding a recession in 2023.

- The consumer remains in solid shape and will help offset weakness in the housing sector.

- Price pressures continue to ease, and the inflation outlook remains good.

- Large bounces off midterm-election-year lows are normal, and we expect this to happen again in 2023.

- The goods sector, both in consumption and production, may be pulling back as the economy continues to normalize.

- Price pressures continue to ease, and the inflation outlook is good.

- Rental prices are decelerating, and the supply picture indicates this trend will likely continue into 2023.

- Gas prices as a deflationary force over the short term;

- A reversal of core goods (ex. food and energy) prices; and

- Shelter inflation pulling back in the back half of the year.

- Employment data continues to show strength, but we are also seeing better news on wages.

- December was historically weak, which has many investors worried. But those concerns could be overblown.

- Santa Claus came to town, which is one less worry for investors.

- Stocks still look very strong, but February can be a tricky month.

- Technology company layoffs have dominated headlines, prompting renewed recession fears.

- Tech firms may simply be retrenching after a torrid pace of hiring over the past decade.

- The good news is the rest of the economy may be picking up the slack.

Array

(

[showposts] => 5

[post_type] => videos

[post_status] => publish

)

WP_Query Object

(

[query] => Array

(

[showposts] => 5

[post_type] => videos

[post_status] => publish

)

[query_vars] => Array

(

[showposts] => 5

[post_type] => videos

[post_status] => publish

[error] =>

[m] =>

[p] => 0

[post_parent] =>

[subpost] =>

[subpost_id] =>

[attachment] =>

[attachment_id] => 0

[name] =>

[pagename] =>

[page_id] => 0

[second] =>

[minute] =>

[hour] =>

[day] => 0

[monthnum] => 0

[year] => 0

[w] => 0

[category_name] =>

[tag] =>

[cat] =>

[tag_id] =>

[author] =>

[author_name] =>

[feed] =>

[tb] =>

[paged] => 0

[meta_key] =>

[meta_value] =>

[preview] =>

[s] =>

[sentence] =>

[title] =>

[fields] =>

[menu_order] =>

[embed] =>

[category__in] => Array

(

)

[category__not_in] => Array

(

)

[category__and] => Array

(

)

[post__in] => Array

(

)

[post__not_in] => Array

(

)

[post_name__in] => Array

(

)

[tag__in] => Array

(

)

[tag__not_in] => Array

(

)

[tag__and] => Array

(

)

[tag_slug__in] => Array

(

)

[tag_slug__and] => Array

(

)

[post_parent__in] => Array

(

)

[post_parent__not_in] => Array

(

)

[author__in] => Array

(

)

[author__not_in] => Array

(

)

[search_columns] => Array

(

)

[ignore_sticky_posts] =>

[suppress_filters] =>

[cache_results] => 1

[update_post_term_cache] => 1

[update_menu_item_cache] =>

[lazy_load_term_meta] => 1

[update_post_meta_cache] => 1

[posts_per_page] => 5

[nopaging] =>

[comments_per_page] => 50

[no_found_rows] =>

[order] => DESC

)

[tax_query] => WP_Tax_Query Object

(

[queries] => Array

(

)

[relation] => AND

[table_aliases:protected] => Array

(

)

[queried_terms] => Array

(

)

[primary_table] => wp_posts

[primary_id_column] => ID

)

[meta_query] => WP_Meta_Query Object

(

[queries] => Array

(

)

[relation] =>

[meta_table] =>

[meta_id_column] =>

[primary_table] =>

[primary_id_column] =>

[table_aliases:protected] => Array

(

)

[clauses:protected] => Array

(

)

[has_or_relation:protected] =>

)

[date_query] =>

[request] => SELECT SQL_CALC_FOUND_ROWS wp_posts.ID

FROM wp_posts

WHERE 1=1 AND wp_posts.post_type = 'videos' AND ((wp_posts.post_status = 'publish'))

ORDER BY wp_posts.post_date DESC

LIMIT 0, 5

[posts] => Array

(

[0] => WP_Post Object

(

[ID] => 77547

[post_author] => 90034

[post_date] => 2023-02-10 12:18:24

[post_date_gmt] => 2023-02-10 18:18:24

[post_content] => Tax season is upon us! Watch our webinar: Tips from a Tax Preparer – Best Practices for the Upcoming Tax Season with Carson Group’s Director of Tax Planning Mike Valenti and Senior Wealth Planner Tom Fridrich, now available on-demand.

[post_title] => Tips from a Tax Preparer

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => everything-you-need-to-know-about-rmds-2-2-2-2-2-3-2-2-2-2-2

[to_ping] =>

[pinged] =>

[post_modified] => 2023-02-10 14:10:22

[post_modified_gmt] => 2023-02-10 20:10:22

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://carsonhub.wpengine.com/?post_type=videos&p=65700

[menu_order] => 0

[post_type] => videos

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[1] => WP_Post Object

(

[ID] => 77472

[post_author] => 90034

[post_date] => 2023-01-27 12:56:44

[post_date_gmt] => 2023-01-27 18:56:44

[post_content] => After a year riddled with market volatility, it’s a good idea to get some market outlook insights from a respected thought leader, Carson Group’s Chief Market Strategist Ryan Detrick.

Watch Detrick’s Carson's 2023 Market Outlook webinar, now available on-demand.

[post_title] => 2023 Market Outlook Webinar

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => everything-you-need-to-know-about-rmds-2-2-2-2-2-3-2-2-2-2

[to_ping] =>

[pinged] =>

[post_modified] => 2023-01-27 13:18:10

[post_modified_gmt] => 2023-01-27 19:18:10

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://carsonhub.wpengine.com/?post_type=videos&p=65650

[menu_order] => 0

[post_type] => videos

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[2] => WP_Post Object

(

[ID] => 77425

[post_author] => 90034

[post_date] => 2023-01-18 07:41:26

[post_date_gmt] => 2023-01-18 13:41:26

[post_content] => Carson Partners’ Ryan Detrick shares key events we saw in the past quarter and how we think they’ll affect markets in 2023. Contact us to speak with a financial advisor.

[post_title] => 2023 Market Outlook

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => 2023-market-outlook

[to_ping] =>

[pinged] =>

[post_modified] => 2023-01-18 07:44:20

[post_modified_gmt] => 2023-01-18 13:44:20

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://carsonhub.wpengine.com/?post_type=videos&p=65612

[menu_order] => 0

[post_type] => videos

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[3] => WP_Post Object

(

[ID] => 77417

[post_author] => 90034

[post_date] => 2023-01-09 13:19:16

[post_date_gmt] => 2023-01-09 19:19:16

[post_content] => The SECURE Act brought big changes to planning for retirement when it was signed into law in 2019. Now, its sequel – dubbed SECURE Act 2.0 – has just passed as part of the 2023 budget.

[post_title] => How SECURE Act 2.0 Shifts the Retirement Planning Landscape

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => everything-you-need-to-know-about-rmds-2-2-2-2-2-3-2-2-2

[to_ping] =>

[pinged] =>

[post_modified] => 2023-01-09 14:08:09

[post_modified_gmt] => 2023-01-09 20:08:09

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://carsonhub.wpengine.com/?post_type=videos&p=65597

[menu_order] => 0

[post_type] => videos

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[4] => WP_Post Object

(

[ID] => 77371

[post_author] => 90034

[post_date] => 2022-12-20 07:45:23

[post_date_gmt] => 2022-12-20 13:45:23

[post_content] => Nobody knows with complete certainty what 2023 will bring for your finances, but we have some educated guesses. Learn about how 2022 events might impact your 2023 in our on-demand webinar A Look Ahead to 2023 with Carson’s Senior Wealth Planner Kevin Oleszewski CFP®, MST, EA.

[post_title] => A Look Ahead to 2023

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => everything-you-need-to-know-about-rmds-2-2-2-2-2-3-2-2

[to_ping] =>

[pinged] =>

[post_modified] => 2022-12-20 08:25:22

[post_modified_gmt] => 2022-12-20 14:25:22

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://carsonhub.wpengine.com/?post_type=videos&p=65555

[menu_order] => 0

[post_type] => videos

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

)

[post_count] => 5

[current_post] => -1

[before_loop] => 1

[in_the_loop] =>

[post] => WP_Post Object

(

[ID] => 77547

[post_author] => 90034

[post_date] => 2023-02-10 12:18:24

[post_date_gmt] => 2023-02-10 18:18:24

[post_content] => Tax season is upon us! Watch our webinar: Tips from a Tax Preparer – Best Practices for the Upcoming Tax Season with Carson Group’s Director of Tax Planning Mike Valenti and Senior Wealth Planner Tom Fridrich, now available on-demand.

[post_title] => Tips from a Tax Preparer

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => everything-you-need-to-know-about-rmds-2-2-2-2-2-3-2-2-2-2-2

[to_ping] =>

[pinged] =>

[post_modified] => 2023-02-10 14:10:22

[post_modified_gmt] => 2023-02-10 20:10:22

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://carsonhub.wpengine.com/?post_type=videos&p=65700

[menu_order] => 0

[post_type] => videos

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[comment_count] => 0

[current_comment] => -1

[found_posts] => 115

[max_num_pages] => 23

[max_num_comment_pages] => 0

[is_single] =>

[is_preview] =>

[is_page] =>

[is_archive] =>

[is_date] =>

[is_year] =>

[is_month] =>

[is_day] =>

[is_time] =>

[is_author] =>

[is_category] =>

[is_tag] =>

[is_tax] =>

[is_search] =>

[is_feed] =>

[is_comment_feed] =>

[is_trackback] =>

[is_home] => 1

[is_privacy_policy] =>

[is_404] =>

[is_embed] =>

[is_paged] =>

[is_admin] =>

[is_attachment] =>

[is_singular] =>

[is_robots] =>

[is_favicon] =>

[is_posts_page] =>

[is_post_type_archive] =>

[query_vars_hash:WP_Query:private] => 94497154a7cc886bc98217b3aab93ba6

[query_vars_changed:WP_Query:private] =>

[thumbnails_cached] =>

[allow_query_attachment_by_filename:protected] =>

[stopwords:WP_Query:private] =>

[compat_fields:WP_Query:private] => Array

(

[0] => query_vars_hash

[1] => query_vars_changed

)

[compat_methods:WP_Query:private] => Array

(

[0] => init_query_flags

[1] => parse_tax_query

)

[tribe_is_event] =>

[tribe_is_multi_posttype] =>

[tribe_is_event_category] =>

[tribe_is_event_venue] =>

[tribe_is_event_organizer] =>

[tribe_is_event_query] =>

[tribe_is_past] =>

)

[post_title] => 2023 Market Outlook

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => 2023-market-outlook

[to_ping] =>

[pinged] =>

[post_modified] => 2023-01-18 07:44:20

[post_modified_gmt] => 2023-01-18 13:44:20

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://carsonhub.wpengine.com/?post_type=videos&p=65612

[menu_order] => 0

[post_type] => videos

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[3] => WP_Post Object

(

[ID] => 77417

[post_author] => 90034

[post_date] => 2023-01-09 13:19:16

[post_date_gmt] => 2023-01-09 19:19:16

[post_content] => The SECURE Act brought big changes to planning for retirement when it was signed into law in 2019. Now, its sequel – dubbed SECURE Act 2.0 – has just passed as part of the 2023 budget.

[post_title] => How SECURE Act 2.0 Shifts the Retirement Planning Landscape

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => everything-you-need-to-know-about-rmds-2-2-2-2-2-3-2-2-2

[to_ping] =>

[pinged] =>

[post_modified] => 2023-01-09 14:08:09

[post_modified_gmt] => 2023-01-09 20:08:09

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://carsonhub.wpengine.com/?post_type=videos&p=65597

[menu_order] => 0

[post_type] => videos

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[4] => WP_Post Object

(

[ID] => 77371

[post_author] => 90034

[post_date] => 2022-12-20 07:45:23

[post_date_gmt] => 2022-12-20 13:45:23

[post_content] => Nobody knows with complete certainty what 2023 will bring for your finances, but we have some educated guesses. Learn about how 2022 events might impact your 2023 in our on-demand webinar A Look Ahead to 2023 with Carson’s Senior Wealth Planner Kevin Oleszewski CFP®, MST, EA.

[post_title] => A Look Ahead to 2023

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => everything-you-need-to-know-about-rmds-2-2-2-2-2-3-2-2

[to_ping] =>

[pinged] =>

[post_modified] => 2022-12-20 08:25:22

[post_modified_gmt] => 2022-12-20 14:25:22

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://carsonhub.wpengine.com/?post_type=videos&p=65555

[menu_order] => 0

[post_type] => videos

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

)

[post_count] => 5

[current_post] => -1

[before_loop] => 1

[in_the_loop] =>

[post] => WP_Post Object

(

[ID] => 77547

[post_author] => 90034

[post_date] => 2023-02-10 12:18:24

[post_date_gmt] => 2023-02-10 18:18:24

[post_content] => Tax season is upon us! Watch our webinar: Tips from a Tax Preparer – Best Practices for the Upcoming Tax Season with Carson Group’s Director of Tax Planning Mike Valenti and Senior Wealth Planner Tom Fridrich, now available on-demand.

[post_title] => Tips from a Tax Preparer

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => everything-you-need-to-know-about-rmds-2-2-2-2-2-3-2-2-2-2-2

[to_ping] =>

[pinged] =>

[post_modified] => 2023-02-10 14:10:22

[post_modified_gmt] => 2023-02-10 20:10:22

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://carsonhub.wpengine.com/?post_type=videos&p=65700

[menu_order] => 0

[post_type] => videos

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[comment_count] => 0

[current_comment] => -1

[found_posts] => 115

[max_num_pages] => 23

[max_num_comment_pages] => 0

[is_single] =>

[is_preview] =>

[is_page] =>

[is_archive] =>

[is_date] =>

[is_year] =>

[is_month] =>

[is_day] =>

[is_time] =>

[is_author] =>

[is_category] =>

[is_tag] =>

[is_tax] =>

[is_search] =>

[is_feed] =>

[is_comment_feed] =>

[is_trackback] =>

[is_home] => 1

[is_privacy_policy] =>

[is_404] =>

[is_embed] =>

[is_paged] =>

[is_admin] =>

[is_attachment] =>

[is_singular] =>

[is_robots] =>

[is_favicon] =>

[is_posts_page] =>

[is_post_type_archive] =>

[query_vars_hash:WP_Query:private] => 94497154a7cc886bc98217b3aab93ba6

[query_vars_changed:WP_Query:private] =>

[thumbnails_cached] =>

[allow_query_attachment_by_filename:protected] =>

[stopwords:WP_Query:private] =>

[compat_fields:WP_Query:private] => Array

(

[0] => query_vars_hash

[1] => query_vars_changed

)

[compat_methods:WP_Query:private] => Array

(

[0] => init_query_flags

[1] => parse_tax_query

)

[tribe_is_event] =>

[tribe_is_multi_posttype] =>

[tribe_is_event_category] =>

[tribe_is_event_venue] =>

[tribe_is_event_organizer] =>

[tribe_is_event_query] =>

[tribe_is_past] =>

)

Videos

Videos

Tips from a Tax Preparer

2023 Market Outlook Webinar

2023 Market Outlook

How SECURE Act 2.0 Shifts the Retirement Planning Landscape

A Look Ahead to 2023

Array

(

[showposts] => 5

[post_type] => news

[post_status] => publish

)

WP_Query Object

(

[query] => Array

(

[showposts] => 5

[post_type] => news

[post_status] => publish

)

[query_vars] => Array

(

[showposts] => 5

[post_type] => news

[post_status] => publish

[error] =>

[m] =>

[p] => 0

[post_parent] =>

[subpost] =>

[subpost_id] =>

[attachment] =>

[attachment_id] => 0

[name] =>

[pagename] =>

[page_id] => 0

[second] =>

[minute] =>

[hour] =>

[day] => 0

[monthnum] => 0

[year] => 0

[w] => 0

[category_name] =>

[tag] =>

[cat] =>

[tag_id] =>

[author] =>

[author_name] =>

[feed] =>

[tb] =>

[paged] => 0

[meta_key] =>

[meta_value] =>

[preview] =>

[s] =>

[sentence] =>

[title] =>

[fields] =>

[menu_order] =>

[embed] =>

[category__in] => Array

(

)

[category__not_in] => Array

(

)

[category__and] => Array

(

)

[post__in] => Array

(

)

[post__not_in] => Array

(

)

[post_name__in] => Array

(

)

[tag__in] => Array

(

)

[tag__not_in] => Array

(

)

[tag__and] => Array

(

)

[tag_slug__in] => Array

(

)

[tag_slug__and] => Array

(

)

[post_parent__in] => Array

(

)

[post_parent__not_in] => Array

(

)

[author__in] => Array

(

)

[author__not_in] => Array

(

)

[search_columns] => Array

(

)

[ignore_sticky_posts] =>

[suppress_filters] =>

[cache_results] => 1

[update_post_term_cache] => 1

[update_menu_item_cache] =>

[lazy_load_term_meta] => 1

[update_post_meta_cache] => 1

[posts_per_page] => 5

[nopaging] =>

[comments_per_page] => 50

[no_found_rows] =>

[order] => DESC

)

[tax_query] => WP_Tax_Query Object

(

[queries] => Array

(

)

[relation] => AND

[table_aliases:protected] => Array

(

)

[queried_terms] => Array

(

)

[primary_table] => wp_posts

[primary_id_column] => ID

)

[meta_query] => WP_Meta_Query Object

(

[queries] => Array

(

)

[relation] =>

[meta_table] =>

[meta_id_column] =>

[primary_table] =>

[primary_id_column] =>

[table_aliases:protected] => Array

(

)

[clauses:protected] => Array

(

)

[has_or_relation:protected] =>

)

[date_query] =>

[request] => SELECT SQL_CALC_FOUND_ROWS wp_posts.ID

FROM wp_posts

WHERE 1=1 AND wp_posts.post_type = 'news' AND ((wp_posts.post_status = 'publish'))

ORDER BY wp_posts.post_date DESC

LIMIT 0, 5

[posts] => Array

(

[0] => WP_Post Object

(

[ID] => 75153

[post_author] => 90034

[post_date] => 2022-05-26 08:18:44

[post_date_gmt] => 2022-05-26 13:18:44

[post_content] => By Erin Wood, Senior Vice President, Financial Planning and Advanced Solutions

Just a few years ago, Rose retired with a decent-sized 401(k). With some careful budgeting and a part-time job, her retirement finances were on track. Rose was looking forward to traveling, reigniting her passion for photography and spending time with her son and her grandkids.

The pandemic changed everything. Her son contracted COVID-19 in the early days of the pandemic. His health deteriorated quickly and he died at only 35 years old. He didn’t have life insurance. A gig worker without a 401(k), he had very minimal retirement savings.

Rose’s grandchildren, ages 2 and 6, joined the more than 140,000 U.S. children under the age of 18 who lost their primary or secondary caregiver due to the pandemic from April 2020 through June 2021. That’s approximately one out of every 450 children under age 18 in the United States.

Rose’s ex-daughter-in-law battles drug addiction and had lost custody of the kids during the divorce, so Rose became the children’s primary caregiver. She quickly discovered that caring for young children as an older adult is more physically challenging than when she raised her son, so she made the difficult decision to leave her part-time job to have the energy to care for her active grandchildren. She wants to do everything for these kids who have lost so much — but it puts her financial security at risk.

Sadly, she is far from alone.

Read the full article

[post_title] => COVID’s Financial Toll Isn’t What You Think

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => covids-financial-toll-isnt-what-you-think

[to_ping] =>

[pinged] =>

[post_modified] => 2022-07-06 13:22:05

[post_modified_gmt] => 2022-07-06 18:22:05

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://carsonhub.wpengine.com/?post_type=news&p=64940

[menu_order] => 0

[post_type] => news

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[1] => WP_Post Object

(

[ID] => 74448

[post_author] => 90034

[post_date] => 2022-05-10 10:24:25

[post_date_gmt] => 2022-05-10 15:24:25

[post_content] => Karn Couzens & Associates, Inc., a full-service financial planning and wealth management firm with offices in Farmington and Wallingford, Conn. announced today that it is joining Carson Wealth. The 10-person team is led by managing directors and wealth advisors, Robert A. Karn, JD, LLM, CFP® and Jeffrey P. Couzens, CFP® and has $800 million in assets under advisement.

“There were a lot of reasons why we chose to partner with Carson,” explains Robert Karn. “But one of the biggest reasons was the industry-leading technology available to us as Carson Wealth and what that will enable us to do for our clients. These tools will help streamline our clients’ digital experience, making it easier for them to visualize their financial plan, access their investments and communicate with our team.”

Robert Karn has been helping high-net-worth families and businesses discover and plan for their financial goals for nearly 40 years. Karn began his career in financial services when he and wealth advisor, Jim Couzens opened Karn Couzens & Associates in 1987.

Jeffrey Couzens joined Karn Couzens & Associates, Inc. in 1997, following in his father, Jim’s footsteps.

“Our goal has always been to deliver maximum value to our clients and provide them with a ‘best-in-class’ experience,” said Jeffrey Couzens. “Aligning with a trusted partner like Carson will allow us more time to foster true partnerships with our clients and help them live their best lives by developing plans to help them prioritize and achieve their financial goals.”

“Bob and Jeffrey have built a tremendous multigenerational family business, dedicated to serving the greater Hartford area,” said Ron Carson, founder and CEO of Carson Group. “As part of the Carson Wealth team, they have access to resources to secure their firm’s legacy and provide so much more for their clients – comprehensive financial planning, trust services, insurance solutions, tax strategy and a dedicated investment management team.”