While no one is going to throw a pity party, there is a growing “problem” half of retirees face.

With retirement account balances at an all-time high, the percentage of Americans projected to be able to maintain their standard of living in retirement rose 2 percentage points from last year, to 50 percent, according to the most recent data from the Center for Retirement Research’s annual National Retirement Readiness Index.

Now, thanks to smart planning — and market highs— more soon-to-be retirees are discovering that their nest egg is just where they want it.

Average retirement balances

| Account type | Q2 2017 | Q1 2017 | One year ago | 5 years ago |

| 401(k) | $97,700 | $95,500 | $89,100 | $73,300 |

| IRA | $100,200 | $98,100 | $89,600 | $73,100 |

SOURCE: Fidelity Investments

Paul West, a managing partner at Carson Wealth Management in Omaha, Nebraska, said he has been fielding more calls from clients in this boat.

“Now they’re asking, ‘Should we take all our chips off the table? What should we do?'” he said.

Here are the next steps:

Reduce equity exposure

After a significant run-up in stocks, (your head may still be spinning after the Dow surpassed 26,000 for the first time and the S&P 500 and Nasdaq hit record highs earlier this week) it’s wise to re-evaluate your equity exposure, West said.

But that doesn’t mean you have to sell something to buy something else. Rather than unloading a winner (and having to pay tax on those gains), use cash that’s sitting on the sidelines from dividends or earned interest to buy bonds or laddered CDs — or just plain leave it alone.

Some advisors suggest readjusting your asset allocation from a 70/30 stocks/bonds mix to enter retirement with a 50/50 split.

Be realistic

“People underestimate what they really think they need, and once they get there they want something additional,” said Michael Bapis, the managing director at HighTower Advisors in New York.

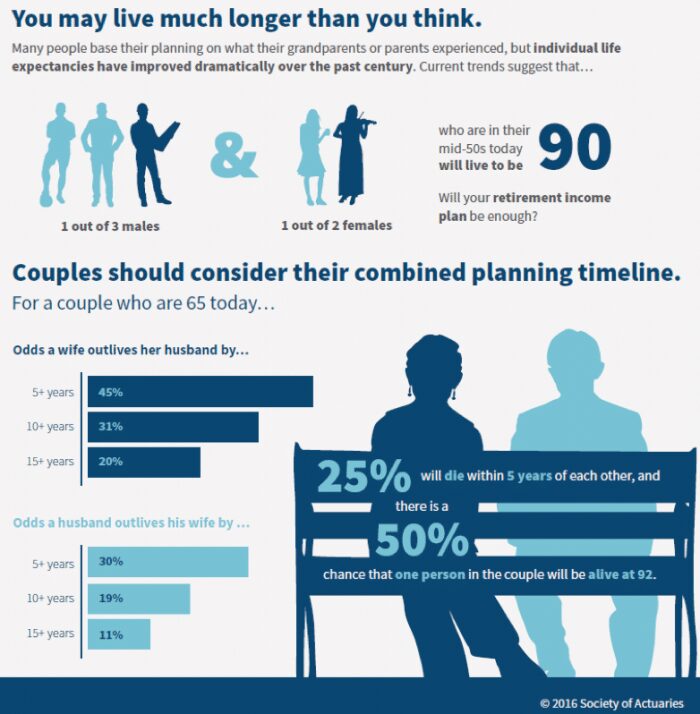

One of the biggest mistakes most make is underestimating their life expectancy.

In fact, 43 percent of retirees and 38 percent of preretirees fell short by at least five years when asked to gauge the average life expectancy for someone of their age and gender, according to a 2011 survey from the Society of Actuaries. (Want to do the math? Check out this calculator.)

With that — and rising medical costs — comes surging projections of what retirees can expect to spend for retirement health costs. A 2016 Fidelity study found a typical retired couple will have $260,000 in out-of-pocket health-care outlays. Long-term care could add another $130,000.

“Be your own life insurance actuary,” said Mark Avallone, president of Potomac Wealth Advisors in Rockville, Maryland, and author of “Countdown to Financial Freedom.” “If you’ve been living healthy, you may have the blessing of living a long life and you need to plan accordingly.”

Think big

Retirement is not just about covering expenses or even maintaining your current lifestyle.

“Most retirees want to travel and visit their grandkids,” West said.

Many investors favor simple rules of thumb, such as the 4 percent rule. But also think about those life rewards once you’ve stopped working — whether it is traveling, relocating or taking up a new hobby. Accommodate that into your financial plan.

Chances are, that will mean you’ll need more discretionary income than you originally thought.

“Don’t aim low during your working years,” Avallone said.

Make a multigenerational plan

Once you are comfortable with your assets, your next step is to begin legacy planning for children and grandchildren, HighTower’s Bapis said.

Over the next few decades, $30 trillion in financial and nonfinancial assets is expected to pass from baby boomers — the wealthiest and one-time largest generation in U.S. history — to their heirs. Aside from gifting, a trust can be a good way to hand money down. It has the added benefit of giving you more control over how your assets are made available to the next generation.

“Map that strategy out now because things can get messy.”-Mark Avallone, president, Potomac Wealth Advisors

Others may opt to give the bulk of their estate away. In that case, consider setting up a charitable remainder trust, using a donor-advised fund or simply leaving a portion of your assets to a specified charity in your will.

“Map that strategy out now because things can get messy,” Avallone said. “Once you are dead you have no control over what happens to your money unless you wrote it down.”

Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing.