A recent, nationwide survey of approximately 1,000 adults found that 86% of those surveyed indicated they are experiencing stress relating to their finances.[1] Why is this important? According to that same survey, nearly half of those who indicated they are experiencing financial stress believe their stress hinders their ability to make financial decisions. Not only are an overwhelming majority of those surveyed stressed about their finances, but when it’s time to make a financial decision, their stress is preventing them from making a decision which may be in their best interest.

The good news – 75% of those surveyed with stress responded favorably to several methods to help reduce their financial stress, including: having a deeper knowledge of finance in general (22%); having a better understanding of their financial situation (14%); and having more time to focus on their finances (12%). The #1 answer shouldn’t surprise anyone – having a financial plan (27%). But when the survey respondents were asked how they cope with their financial stress, only 5% indicated they contact a financial professional!

Why is this number so low? Either the respondents like living with stress that affects their financial decision making or they haven’t seen the results of the Household Financial Planning Survey, which examined approximately 1,500 American households’ financial priorities, savings and preparedness on a series of financial goals and explores the impact of financial planning on household financial decision makers’ outlook and outcomes across a range of incomes.[2] The survey found:

- Planners are more likely to feel on pace to meet all of their financial goals

- Planners feel more confident about managing money, savings and investments than non-planners across all income levels, and are more likely to describe themselves as living comfortably

- Planners report more success, including saving a higher percentage of their income and building greater wealth than non-planners

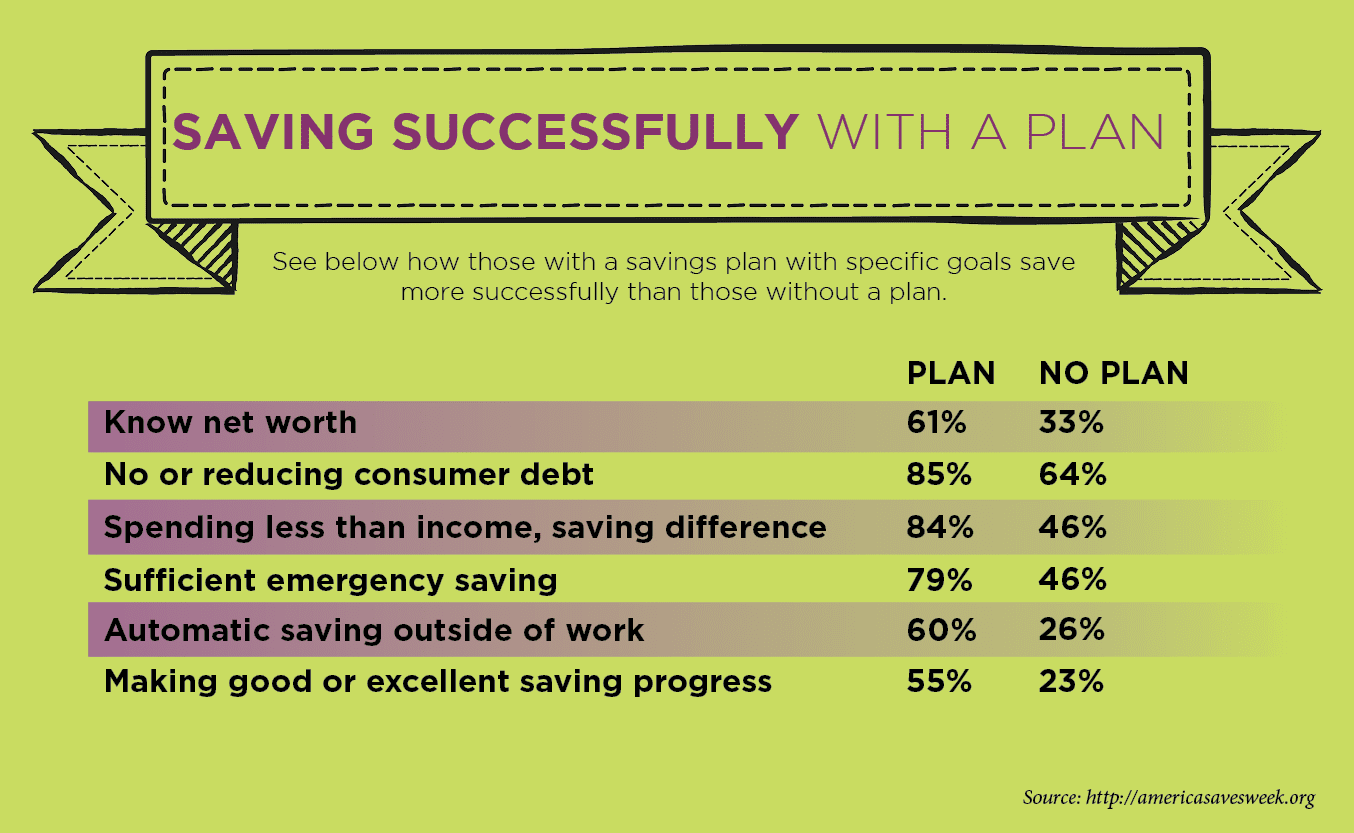

If you still don’t think you need a financial plan, consider the recent results of the America Saves Week survey, a sample of approximately 1,000 American adults in January 2017.[3]

- 88% of respondents with a financial plan are reducing consumer debt or are debt-free

- 82% of respondents with a financial plan have sufficient emergency savings

- 86% of respondents with a financial plan are spending less than their income and are saving the difference

Did you know that April is National Stress Awareness Month[4]? If you’re experiencing financial stress (and frankly, who isn’t after tax season?) and want to proactively reduce your stress levels, contact your advisor and make a plan today!

Looking for additional information before you meet with your advisor? Check out some of our planning resources:

Are you stressed about your finances? Contact your advisor to develop a plan today!

[vc_column][vc_separator color=”mulled_wine” style=”dashed” border_width=”8″]

Monthly Investment Review: March 2017

Historically speaking, March has been one of the highest returning months on the calendar. The S&P 500 has averaged a 2.70% return for the month over the past ten years and, with markets on a tear since the 2016 election, history appeared ready to repeat itself. However, the Dow Jones Industrial Average and the S&P 500 were both down in March, posting returns of -0.72% and -0.04%, respectively. The NASDAQ Composite, on the other hand, returned 1.48% over the same period, besting the two large-cap stock indices. In addition, crude oil experienced some volatility as OPEC declined to publicly extend the production cuts, choosing instead to push the decision to its next meeting. Oil fell on the news, dropping below the psychologically significant level of $50 per barrel before rebounding towards the end of the month. Despite OPEC’s effort to reduce supply, demand continues to stay relatively muted which is weighing on prices. Also during the month, Congress voted against President Trump’s changes to the Affordable Health Care Act, sending our domestic markets down more than 1% and snapping a low-volatility streak that lasted more than 100 days. Across the Atlantic, the UK finally made its formal request to leave the European Union. By triggering Article 50, Britain is granted two years to negotiate an exit deal. Once set in motion, the action cannot be undone without a unanimous vote from the member parties. Surprising many, Britain has posted extremely favorable economic indicators since the announcement was made last June. Still, there remains significant uncertainty over the near term and we expect the region to remain volatile throughout the negotiations.

[1] ORC International, Stress Awareness Month Survey Report, 2015.

[2] 2013 Household Financial Planning Survey and Index, prepared by the Consumer Federation of America and Certified Financial Planner Board of Standards, Inc. https://www.cfp.net/docs/public-policy/infographic-hpi-2013.pdf?sfvrsn=2

[3] America Saves and American Savings Education Council 2017 National Survey Assessing Household Saving https://americasavesweek.org/wp-content/uploads/2017/02/America-Saves-Week-2017-Infographic.pdf

[4] https://stressawarenessmonth.com/

GENERAL DISCLOSURE

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Due to volatility within the markets mentioned, opinions are subject to change with notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results. Please note that neither CWM, LLC nor any of its agents or representatives give legal or tax advice. For complete details, consult with your tax advisor or attorney.

DJIA

The Dow Jones Industrial Average is comprised of 30 stocks that are major factors in their industries and widely held by individuals and institutional investors.

NASDAQ COMPOSITE

The NASDAQ Composite Index measures all NASDAQ domestic and non-U.S. based common stocks listed on The NASDAQ Stock Market. The market value, the last sale price multiplied by total shares outstanding, is calculated throughout the trading day, and is related to the total value of the Index.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.