Published by Jason Comes | @Jason_Comes

Wealth…What does it mean to you? I ask this to clients and get many different answers. It means different things to different people. One client said they didn’t think they were in the category of “wealth” as they thought you had to have millions to be in that classification.

The word itself can be quite intimidating, but “True Wealth (all that money can’t buy and death can’t take away)” is what we all should figure out at some point in our lives.

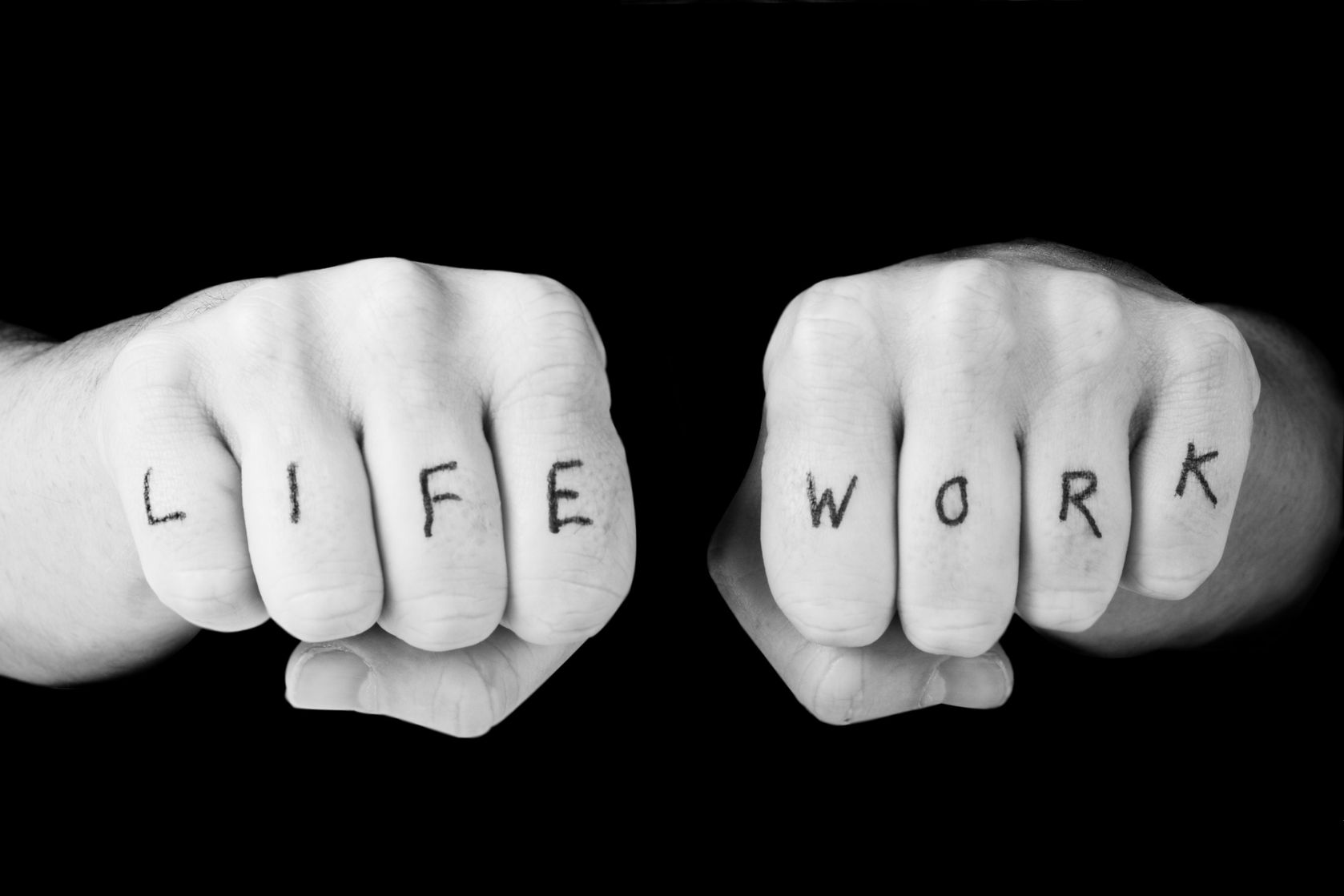

We use terms such as Family Index Number, Personal Financial Plan or Financial Planning on a daily basis in helping our clients manage their assets. But ultimately, we want to get them thinking about what they really want to leave as their legacy; their True Wealth. True Wealth involves more than just investment strategies, portfolio management tools and asset allocation models. True Wealth involves planning for your life dreams and goals. We want you to think about living your life BY DESIGN, not by default.

So set aside some time in the near future to figure out what True Wealth means to you. Your life will have much more meaning as you get ready for retirement or are living in your dream years! And you don’t have to have millions to live your True Wealth journey.