By Mark Petersen, Vice President, Affluent Wealth Planning

You’re turning 65 this year and Medicare is on your mind. Medicare is a subset of Social Security and run by the Social Security Administration. In my experience, it may be almost as complicated as the Internal Revenue Code!

With that said, let’s look at some common questions about Medicare.

When am I eligible for Medicare? Age 65. The enrollment period starts in the third month before your 65th birth month and ends in the third month after your 65th birth month (7 months total).

Do I want to sign up at age 65? It depends. If you’re still working and are covered by an employer or individual health plan, or you are covered by your spouse’s employer or individual health plan, you may meet the Plan B and Plan D exceptions, which will waive the penalties if the coverage is ‘creditable’.

What is ‘creditable’ coverage? Creditable coverage is health insurance, prescription drug, or other health benefit plan that meets a minimum set of qualifications.

Enrollment Periods (and Late Penalties)

How long do I have to sign up when employment ends? You have 8 months after the month employment ends in a ‘Special Enrollment Period’ (SEP) to enroll in Medicare Parts A and B.

What is the penalty for not signing up for Part B during my initial enrollment period? The penalty for not enrolling in Medicare during the initial enrollment period may be 10% of the Part B premium for each year you delay in signing up.

What is the penalty for not signing up for Part D? 1% for each month you delay in signing up beyond your 65th birth month. This penalty applies for the remainder of your life. If you are using an HSA plan with a High Deductible Health Plan (HDHP), your HDHP may not be creditable, which means you are incurring a lifetime penalty while you are covered under an employer-provided prescription drug plan.

What if I utilize an HDHP and switch to a Preferred Provider Organization (PPO) in the last year before I quit working? A Part D late enrollment penalty may apply if you are out of a creditable plan for a continuous period of 63 days or more. The penalty is 1% of the ‘national base beneficiary premium’ amount ($33.19 in 2019) for months you did not have creditable coverage.

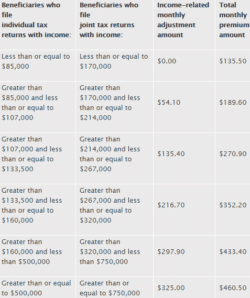

What amount will I pay for Medicare Part B coverage? It varies, depending upon your Total Income from the 2nd prior tax year (2017 Income for 2019 Part B premiums.) The 2019 monthly Medicare Part B premium is $135.50. See the chart below:

What is the Income-Related Monthly Adjustment (IRMA) amount? IRMA is the monthly surcharge one pays for their Medicare Part B premiums for having a ‘high income’ two years prior to the current year.

Medicare Supplement

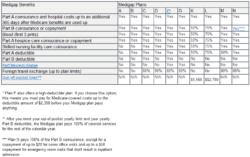

What is a Medicare Supplement Insurance Plan (Medsup, Medigap)? A Medicare Supplement Plan generally covers costs which Medicare Part A and Medicare Part B plan do not cover. All plans of a certain type have the same coverage (standardized policy). The premiums vary by company and the company sets the premiums annually for their Medigap Plans.

How does one choose a Medigap insurance company? There may be free local resources to provide help in gathering information on various providers offering coverage in your state, such as Volunteers Assisting Seniors. In addition, there are insurance agents with information available on companies they represent. Agents earn a commission for placing a Medigap policy and helping with the application process.

Is medical underwriting required to qualify for a Medigap policy? No, during the initial enrollment period for Medicare Part B, medical underwriting is not required to qualify for coverage.

May one change Medigap companies in the future? Yes, however, coverage is not assured. Medical underwriting may be required and result in denial or higher premiums. It may be important to consider a company you wish to stay with for the rest of your life when choosing a Medigap policy.

What if my Medigap company goes out of business? If your Medigap carrier goes out of business, you have an open enrollment period to choose a different insurance company with a waiver of medical underwriting.

Prescriptions

How do I choose a Part D, prescription drug insurance plan? The Medicare.gov website has an interactive page which provides companies offering Part D prescription drug plans in each state. The site also compares premium prices and ranks the companies based upon the prescription list entered by you to help determine the total anticipated premium and drug cost by company. You may enroll directly on the website.

Will I stay with the same Part D, prescription drug plan for the remainder of my life? No, Part D has an open enrollment period each Fall to choose a Part D plan for the following year, based upon new or changed prescriptions and current needs.

I have decided to enroll in Medicare Part A, Part B and Part D. I have decided which Part B plan I want and the insurance agent I want to help me acquire my Medigap coverage. What are my next steps? You enroll in-person at a Social Security office or you can enroll online. The website has a Medicare-only button to limit your application to only begin receiving your Medicare benefits while deferring receipt of your Retirement Benefit.

Is there anything I need to do to sign up on the website? You have to create an account with my Social Security. Have the information below on hand when creating an account at my Social Security.

Note: This account may not be created if you have a credit lock or credit freeze with Equifax. The lock or freeze must be temporarily lifted (which the Social Security Administration does not recommend) to create a new my Social Security account.

To create an online account without unlocking a credit freeze requires a trip to the nearest Social Security office.

- If you have signed up for Part A and Part B benefits online, you may not make an appointment. You will be a walk-in service recipient.

- If you have not signed up for Part A and Part B benefits, you may make an appointment to sign up for benefits and create an online account, at the same time.

On a 12 degree day with a windchill below 0, we were the 20th people in line, 20 minutes before the office opened. The office allowed people inside 15 minutes early to get out of the cold and we were finished with the process of setting up an online account (with 2-factor verification for enhanced security – our choice) and receiving our Medicare letter and number, 15 minutes after the office opened.

With our Medicare number in-hand, we may now sign up for a Medicare Supplement policy and Medicare Part D for prescription coverage. Signing up for Medicare coverage is a multi-step, time consuming process. It is advised that one starts this process immediately when eligible, in the third month prior to one’s 65 birth month.

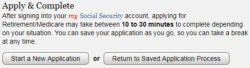

Now that I have my Social Security account, what is the next step? Returning to the SSA website, you want to click on the ‘Start a New Application’ button and follow the instructions.

Upon completion of the application, a Social Security Representative will call you to verify very personal information (i.e. at what age did you first pay FICA tax? What are your parent’s names?). Upon successfully answering the questions, a Medicare Card will be mailed to you indicating that you are enrolled in Medicare and eligible to receive services. This card is necessary to indicate qualification Medigap coverage and must be supplied to your insurance agent to qualify for a Medigap policy.

Congratulations! You have completed the first steps toward your new, life-long health plan.

Why Don’t People Talk Medicare?

There are many reasons people tend to avoid the topic of Medicare.

- It is complicated

- It deals with the prospect of age and failing health

- It is run by a Federal government bureaucracy

Though the discussion may be difficult to start, Medicare is an important topic, not to be avoided, but embraced. Please contact your wealth advisor today, to help you navigate the complex world of Medicare. Let’s talk through your needs and your dreams for this part of life, and demystify the process.