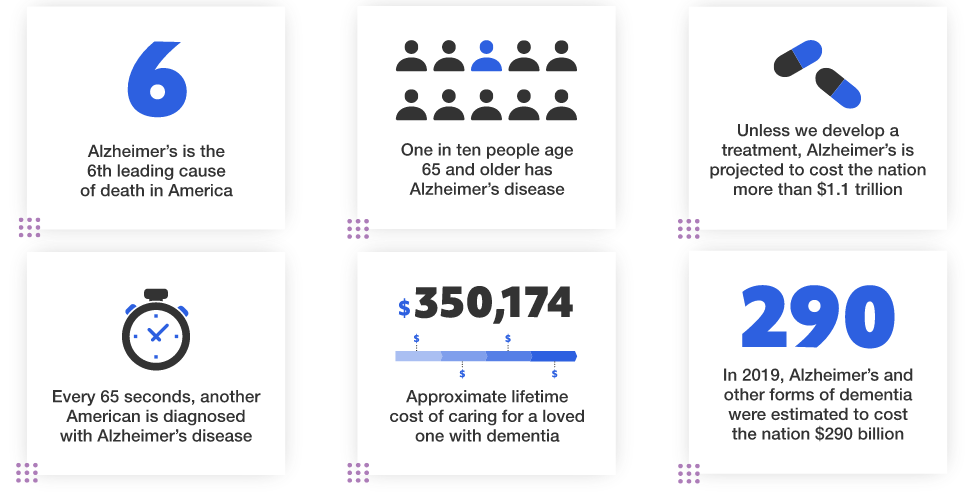

Do you know someone who has recently been diagnosed with dementia or is currently living with this disease? Watching a loved one lose their independence, memories and financial well-being is very difficult. It’s important to know there are many resources and tools available to you. This infographic shares 10 ways you can help your loved ones financially prepare for the impact of dementia.

Compounding Wealth (and Wisdom)

No single strategy works forever, but you also don’t want to change your approach every time the markets shift slightly. How does investing work – not just for a season or a year or two, but for a lifetime? Time is a major factor when it comes to successful investing.