Published by Tyler Schlumpf

We’re going to introduce a few mathematical concepts in this article that are crucial to building a portfolio. For those that are already moving their cursor up to the X in the right hand corner, just stick with it! These concepts, whether we choose to learn them or not, have a significant impact on the way we combine investments and are important to understand as we discuss portfolio construction. Most people that are passively familiar with investing have heard the term “diversification”, but we want to take that to a new level.

To use a very simplistic example, let’s start with a portfolio of just one stock. The first step in diversifying this portfolio is to buy more companies. After all, as long term investors we aren’t rewarded for taking risks that can easily be diversified away through adding a few more securities to a portfolio.

The second step, and most common stopping point for investors, is to add some bonds to the same portfolio of stocks. This traditional, two-step approach to asset allocation allows the investor to create a portfolio of diversified investments dependent on their risk tolerance. But what if there was a third step many are missing when building their asset allocation model? Furthermore, what if I told you this last step could help improve the risk-adjusted returns? This is where the idea of hedged equity strategies, or as we call them, Irreplaceable Capital, can add tremendous value to an investor’s portfolio.

Before going into detail on the “What” and “How” as it relates to our Irreplaceable Capital approach, I want to introduce the first mathematical concept that a lot of investors overlook. Let’s say we have a $10,000 stock portfolio that fell 50% during the 2008 market crisis. If we asked how much our fictitious portfolio would have to earn to get back to even, many would quickly answer that 50% should get us there. However, when we do the math we only get to $7,500. In fact, the investor who lost 50% in 2008 would have to earn 100% just to break even.

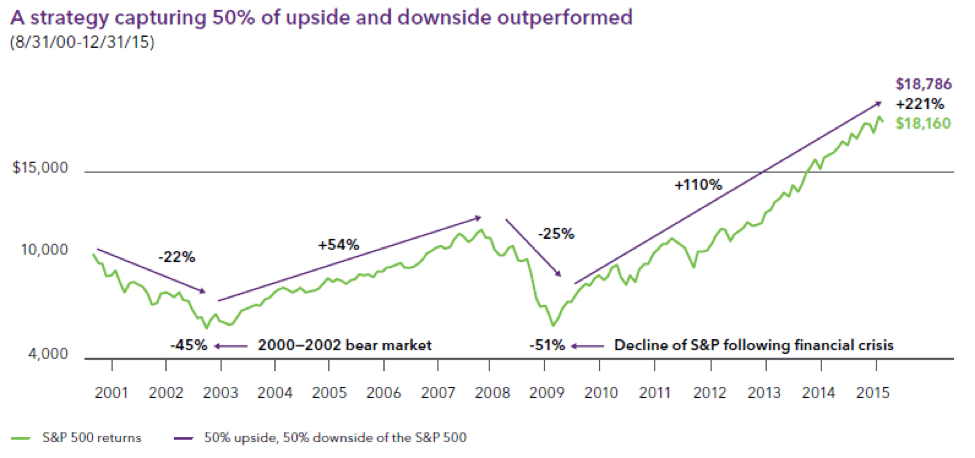

This is a serious uphill battle and one that many investors do not have the fortitude to weather. Even a diversified investor with a moderate portfolio consisting of 60% in the S&P 500 and 40% in a broad bond fund would have experienced roughly a 33% drawdown during the same period. They would have to earn nearly 50% to get back to where they were pre-market crisis. According to a study by BlackRock, their research found that a strategy which simply captures just 50% of the upside and 50% of the downside of the S&P 500 outperformed one that captured 100% of both. It’s almost counterintuitive but the math can’t be denied.

Source: BlackRock (Keeping Your Balance, 10/2016)

For our second mathematical concept, we wanted to introduce correlation. Correlation measures the degree to which two securities or investments move in concert with each other. A correlation of 1.0 means the two investments move in the same direction at the same time while a perfect negative correlation of -1.0 means they move in the opposite direction.

When building or adding to a portfolio, it is extremely helpful for investors to look at how a new investment is correlated to the existing allocation. Adding securities that have a high positive correlation only contributes to the portfolio’s risk while adding investments with a low positive or even negative correlation to the portfolio tends to smooth out the returns and create a less volatile allocation with better risk-adjusted returns.

If we can minimize, or at the very least, reduce the drawdown for a portfolio and produce an uncorrelated return stream, we accomplish two significant goals as it relates to portfolio construction. First, we don’t have to reach for excess returns to make up for the losses as exemplified by the unlucky investor above. Too often we as investors take on too much risk in hope of better returns.

The Irreplaceable Capital approach, through a core holding of stocks along with options to hedge against drawdowns in the market, helps reduce the drawdown and provide an uncorrelated addition to a portfolio. The combination of the equities with options designed to protect the portfolio alters its return profile, thus driving the diversification above and beyond simply combining stocks and bonds.

One of the reasons we are writing this article is not just to reinforce the concept of hedged equity, or “Irreplaceable Capital” strategies, but also to let investors know about the risks they’re taking in traditionally allocated portfolios.

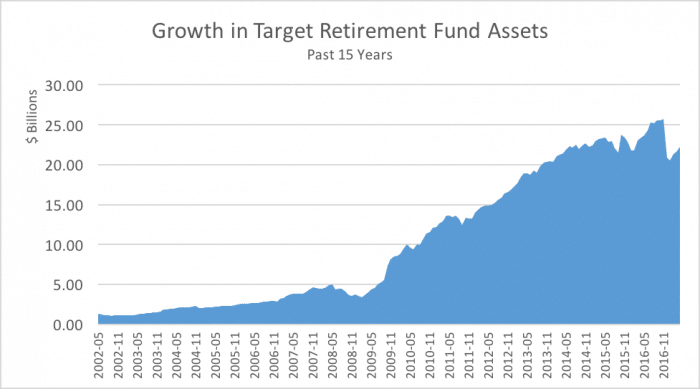

By most measures, our domestic market appears overvalued and we have enjoyed strong returns over the recent past. The bond market, coming off a multi-decade bull run with falling interest rates, is now at an inflection point with all signs indicating that we are in for a rising rate environment. All else being equal, falling rates tend to negatively impact bonds. Combine an overvalued stock market and rising rates, investors using a diversified portfolio of stocks and bonds to manage risk could be in for a surprise as their bond allocations may not provide as much risk mitigation as they originally thought. What stood out to our research team was the degree to which such a large amount of assets have been flowing into funds that subscribe to this methodology despite the risks.

The chart below shows the explosive growth in total net assets for a type of mutual fund, called a target retirement fund, which leans on the traditional asset allocation approach of stocks and bonds to manage risk. These funds offer investors a choice of funds that are managed around a specified range of retirement years with varying degrees of equities and fixed income.

Source: Morningstar Direct

As long term investors, we cannot deny the math behind portfolio construction. To do so only leaves one overexposed to risk and the potential for painful drawdowns and negative returns as we look across the full market cycle. Most of us recall the turmoil of the Great Recession, especially those that watched both their stock and bond allocations fall along with the market.

The idea of Irreplaceable Capital can be a compelling addition to an existing portfolio and we encourage investors to work with their advisor to see how these strategies fit in their overall plan.

—

A diversified portfolio does not assure a profit or protect against loss in a declining market. Asset allocation will not guarantee a profit or protect you from loss however, it may provide a hedge against risk and create opportunities in both bull and bear markets. Historical returns of indices are for illustrative purposes only and are not an indication of future performance of either the indices or any particular investment. It is not possible to directly invest in an index.