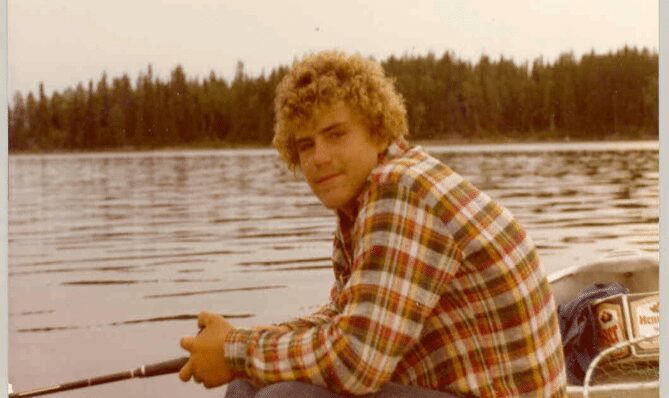

Published by Ron Carson

People often ask me why I became a financial advisor and fiduciary. My answer usually surprises them.

I grew up on a farm in Nebraska—but when I was a teen, my dad impressed on me that there wasn’t much future in running a farm. “You’re going to have to find something else to do,” he told me.

One day when I was bored in a library study hall at my high school, I happened to leaf through an issue of Money magazine. It said one of the top 10 careers of the future was being a CERTIFIED FINANCIAL PLANNER™. I’ll do that, I decided.

The idea of wearing a suit and tie every day sounded great, especially after all the years I had helped my dad work on our farm and fix equipment—and trying to get the grime off my hands afterward. And I’d always been interested in finance since my mother helped me open a commodities account as a teen.

Surprisingly, I stuck with my snap decision. I started my financial advisory business earlier than I expected when I was injured playing football for the University of Nebraska in college. From my dorm room, I began cold calling people in the phone book to sell them universal life insurance. I would cold call for two, three or four hours a day to get two or three appointments. My friends thought I was crazy to work that hard while going to school, but after helping my dad, a workaholic, I found it easy. Each time I made two or three hundred dollars, I felt like I was having tremendous success.

By 1987, I was married and was working from a studio apartment where I lived with my wife. I had expanded beyond selling life insurance to other products. The business was humming along until the stock market crashed that year. Then I hit a week where I could not sell anything. I started losing hope.

One day when I was full of despair, I decided to call all of my clients to see how they were doing. Some of them were touched that I had called when I was not trying to sell them something. I was amazed by how much it meant to them. I started getting to know them better, which I found very rewarding personally.

That experience inspired me to stick with my business. I saw that being a financial advisor put me in a position where I could make a difference for my clients. And later, when the economy came back, I discovered that if I was willing to give anything without expecting something in return, it would come back tenfold. The universe has a way of rewarding you for doing good.

As the economy recovered, I continued to grow my business. By attending events in my community, I began to meet more clients and obtain referrals. I saw that if I had a tenacious focus on serving clients’ best interests, a relentless pursuit of excellence across every activity and a burning desire to learn, grow intellectually and innovate like the best financial advisors I saw, I would be able to build a successful firm. By sticking with that approach, I found that money showed up when I needed it to grow the business.

Today, Carson Group has grown to over 8.5 billion in assets under advisement, which includes assets under management*. I was honored to be one of two advisors in the Barron’s Inaugural Hall of Fame and to be ranked 13 out of thousands of advisors on the Forbes list of America’s Top Wealth Advisors**.

The business of being a financial advisor and fiduciary has changed a lot since I started out. Technology has made it very simple for our clients to monitor their investments and measure how well we are serving them. As a personal financial advisor, I welcome this challenge, and so does my team. We have invested heavily in a dashboard that makes it very easy for clients to see exactly how their portfolio is performing 24/7. We pride ourselves on bringing our clients a Four Seasons experience with FedEx efficiency—and the transparency our technology brings makes it possible to show, without a doubt, the value that we bring.

Although the reason I became a financial advisor was pretty random, the reason I have stuck with it all these years is not. If you’re in this profession for the right reasons, it will energize you in ways you might never have imagined. The opportunities I’ve had to help people have given me a return on psyche that far exceeds anything I’ve been able to do for my clients—and I expect that to continue for many years.

*Please note that the amount of CWM, LLC’s Assets Under Advisement is considerably larger than the amount of the firms regulatory Assets Under Management. Assets Under Advisement include regulatory Assets Under Management reported in CWM, LLC’s Form ADV I, in addition to assets with respect to which CWM, LLC may provide consulting and/or financial planning services, but does not have any management, execution or trading authority. CWM, LLC’s regulatory Assets Under Management can be found in Item 5.F of CWM, LLC’s Form ADV I, available at https://www.adviserinfo.sec.gov.

**Recognition from rating services or publications is no guarantee of future investment success. Working with a highly rated advisor does not ensure that a client or prospective client will experience a higher level of performance of results. These ratings should not be construed as an endorsement of the advisor by any client nor are they representative of any one client’s evaluations. Forbes ranking algorithm is based on quality of practice, including: telephone and in-person interviews, client retention, industry experience, review of compliance records, firm nominations and quantitative criteria. Barron’s rankings are based on data provided by over 4,000 of the nation’s most productive advisors. Factors included in the rankings: assets under management, revenue produced for the firm, regulatory record, quality of practice and philanthropic work