By Scott Kubie, Senior Investment Strategist

The start of the year is the season for market updates. Financial advisors often host events for their clients during the winter months, providing presentations and, even better, investment experts to deliver the presentation and answer questions that clients might have about the markets.

I like every part of the presentation experience. Meeting the clients is motivating. I enjoy sharing what recently happened in markets, speaking to the current situation, and educating clients about future opportunities and risks. What I enjoy most is answering clients’ questions.

These are some questions that have been on clients’ minds and a shortened version of the answers I shared.

U.S. stock markets have historically gone up around 10% per year over the long run. Should we anticipate similar returns in the future?

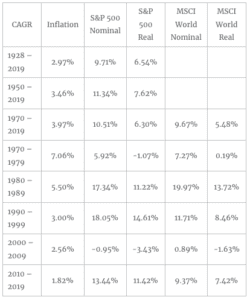

Investors should temper their expectations for future stock returns. From 1970 through 2019, the S&P 500 rose 10.5%. Global developed stocks, represented by the MSCI World, rose 9.7%. Over that period, inflation was nearly 4% most of the time. Using 10% as a rough estimation for global stocks and 4% for inflation, stocks real return – or the return above inflation – was about 6%. Currently inflation is below 2%. Assuming inflation reaches 2% in the future, a consistent real return of 6% would pull estimates down to 8%.

Valuations are also pushing our expectations lower for future returns. Twenty-one times in the past 12 months earnings, the S&P 500 looked more expensive than average. Valuations can act as a restrictor on the pace of returns. While not extremely expensive, it seems reasonable to slice a little off future returns.

The long-term expected returns for stocks will likely be lower than the historical nominal level. Even with some discounts for lower inflation and higher valuations, we still see stocks as the key long-term investment for growing wealth above the rate of inflation.

How will the ballooning U.S. deficit affect markets?

Hardly anyone seems to care about the deficit. The Republicans don’t care. The Democrats don’t care. The bond market doesn’t care. That may be a reason to worry even more, but other countries, like Japan, have run much larger budget deficits relative to their economy, and rates remain very low.

Deficits have grown as economic growth has slowed and the power of governments to maintain high tax rates has dropped off. Companies will relocate to other regions or countries to avoid high taxes on corporations as well as on their workers. Because the jobs that corporations bring are more important than the tax revenue on earnings, governments have spent more as key generations enter retirement while being unable to pass those costs on to taxpayers at this time.

Having an economy that is growing, with a growing tax base, can be more attractive than a smaller deficit with slow growth. The crucial factor for deficits is keeping bond markets confident that the borrower can continue to make payments and roll over debt. As long as investors are confident someone will keep lending the government money, deficits have a much lower impact on markets than many expected.

How will the elections affect my portfolio?

I used to say the most damaging thing an investor could do to hurt future portfolio returns is watch financial news all day. All the excitement from this stock’s earnings or that stock’s decline can turn people into short-term traders rather than long-term investors. While the challenges of financial news still exist, the trend toward watching political news and networks that target particular political audiences has made watching political news a bigger problem in my view.

For the politically motivated, please remember stocks have performed well during the Trump administration. They also performed well during the Obama administration. If you are highly politically engaged, odds are one of those administrations wasn’t your favorite. Yet, stocks did well under both. So, my key advice is keep your politics out of your portfolio.

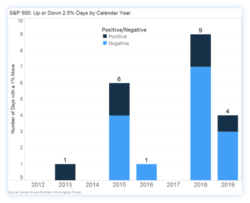

We expect more sharp volatility in markets because of political swings or policy changes. In the last two years, the S&P 500 moved more than 2.5% in either direction 13 times. That was approximately 50% more than it moved the previous six years combined. Policy-driven markets will likely experience more sharp jumps in either direction. Make sure your portfolio is ready.

Past performance is not an indication or guarantee of future results.

Appendix:

http://pages.stern.nyu.edu/~adamodar/