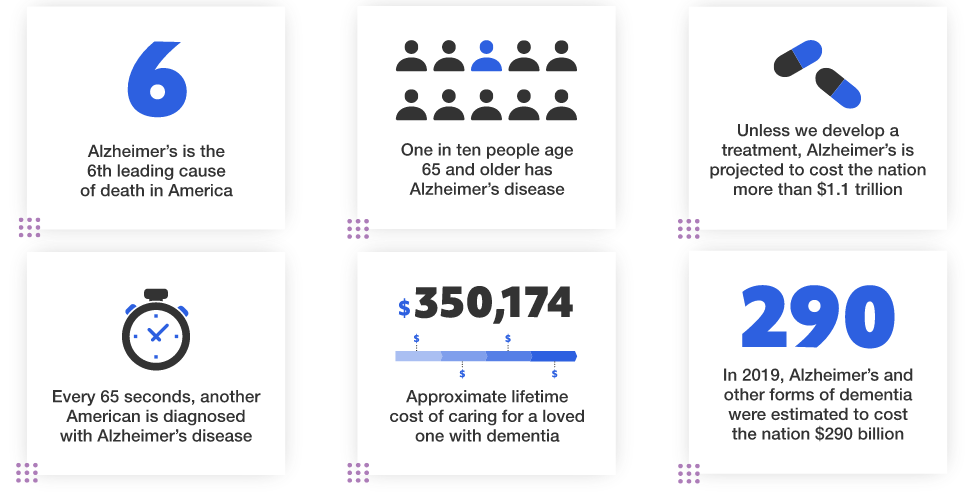

Do you know someone who has recently been diagnosed with dementia or is currently living with this disease? Watching a loved one lose their independence, memories and financial well-being is very difficult. It’s important to know there are many resources and tools available to you. This infographic shares 10 ways you can help your loved ones financially prepare for the impact of dementia.

How Will My Financial Plan Change Over the Course of My Life?

Your career and lifestyle look completely different when you’re in your 20s compared to when you’re in your 60s – your financial focus and planning in each decade should follow suit. Let’s look at three financial tactics to focus on in each decade of your life starting with your 20s.